Nvidia hits fresh intraday record as Citi sees AI capex hitting $2.8 trillion

Nvidia (NVDA) stock rose more than 2% in morning trading on Tuesday to a fresh record of over $186.

The stock's rise comes as Citi (C) analyst Atif Malik on Tuesday forecast that AI capital expenditures from 2025 through 2029 would hit $2.8 trillion.

Also on Tuesday, CoreWeave (CRWV), an Nvidia-backed company that's also a major customer of Nvidia, announced a $14 billion deal with Meta (META), which CEO Michael Intrator revealed during an interview with Bloomberg, sending the stock up.

Nvidia has

also unveiled its own recent flurry of deals, from a $100 billion investment in

OpenAI (OPAI.PVT) to a $5 billion stake in Intel (INTC).

CoreWeave stock surges on AI infrastructure deal with Meta

CoreWeave's (CRWV) shares jumped over 9% in premarket trading after it inked a $14.2 billion deal to provide Meta (META) with AI computing power.

The Nvidia-backed (NVDA) AI data center operator will give Meta access to the chipmaker's latest GB300 systems, Bloomberg reported.

Its Meta partnership is the latest in a flurry of recent multibillion-dollar deals that highlight the high costs of and demand for AI infrastructure. These range from Nvidia's $100 billion investment and collaboration with OpenAi, while the ChatGPT maker itself has sealed a reported $300 billion contract with Oracle (ORCL).

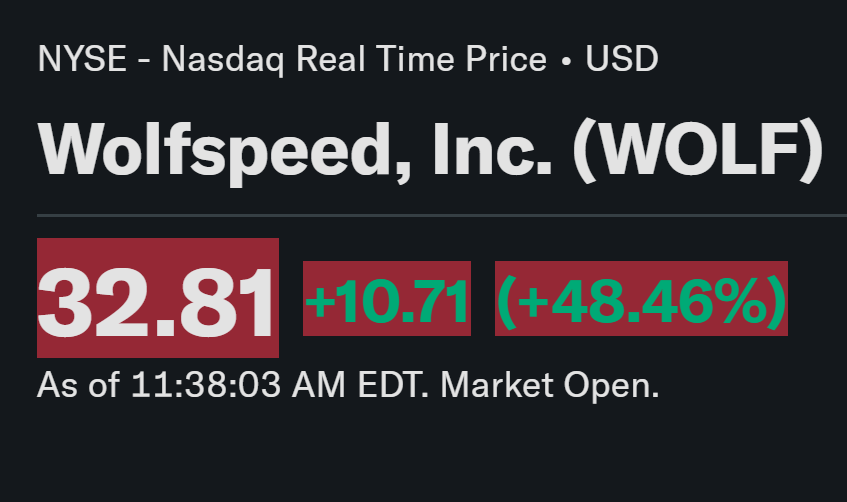

Wolfspeed shares rally after chipmaker exits Chapter 11 bankruptcy

Wolfspeed (WOLF) stock surged more than 25% before the bell on Tuesday, after the chipmaker emerged from Chapter 11 bankruptcy and said it reduced its overall debt by about 70%.

September consumer confidence falls to lowest level since April

US consumer confidence fell in September as Americans worried about inflation and became concerned about future job availability.

The Conference Board’s Consumer Confidence Index declined by 3.6 points in September to 94.2 from 97.8 in August. The Present Situation Index, which tracks consumers’ views on current business and labor market conditions, dropped 7 points to 125.4.

Wall Street stocks rose again Wednesday, shrugging off the partial US government shutdown as major indices finished at records amid hopes for more Federal Reserve interest rate cuts.

Both the Dow and S&P 500 closed at fresh records as investors focused on poor US employment data, which boosted expectations that the Fed could cut interest rates later this month.

US government operations began grinding to a halt at 12:01 am (0401 GMT) Wednesday after Republicans and Democrats failed to break a budget impasse in Congress.

But investors are concerned the US government shutdown could prevent the release Friday of the key non-farm payrolls report -- a crucial data point for the Fed on rate decisions.

European markets were lifted by pharmaceutical shares after Pfizer was granted reprieve from Trump's tariffs by agreeing to lower drug prices in the United States.

Shares in British pharma giant AstraZeneca rose more than eight percent and GSK was up over six percent in London.

Several US pharma names also rose, including Merck and Bristol-Myers Squibb, while Lithium Americas Corp. surged 23.3 percent after announcing it would grant the US government an equity stake as part of the restructuring of a loan from the Department of Energy.