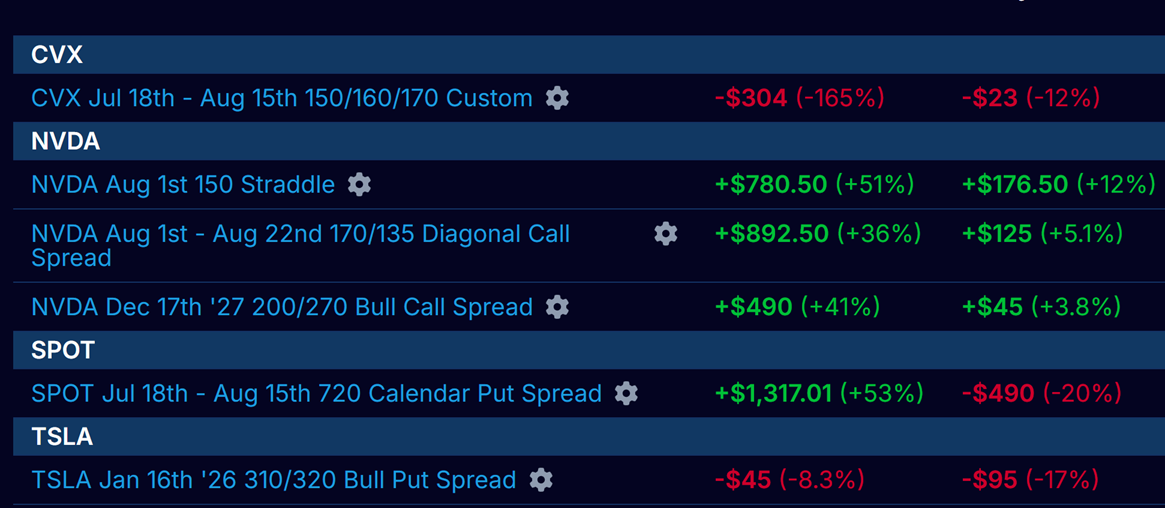

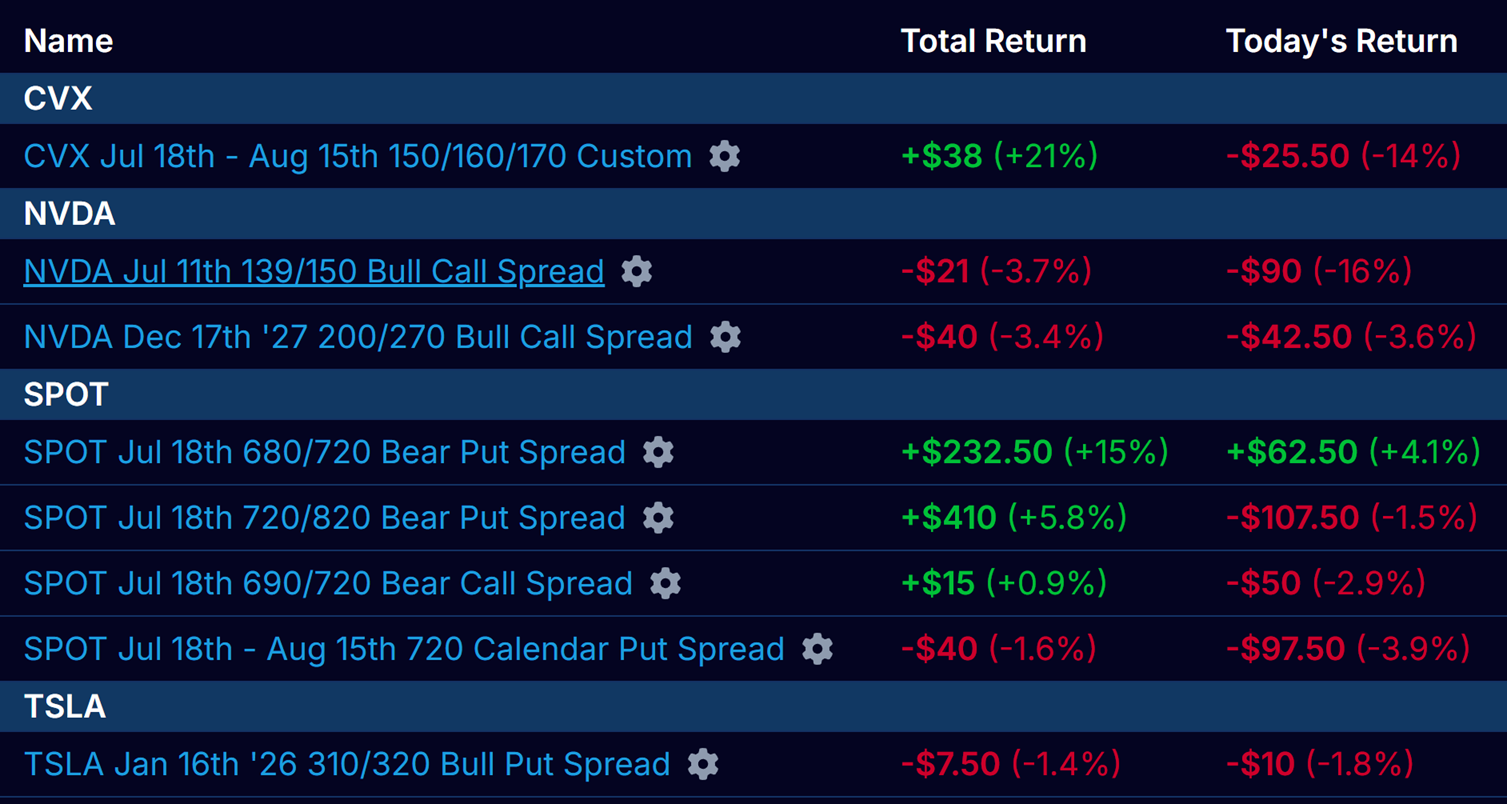

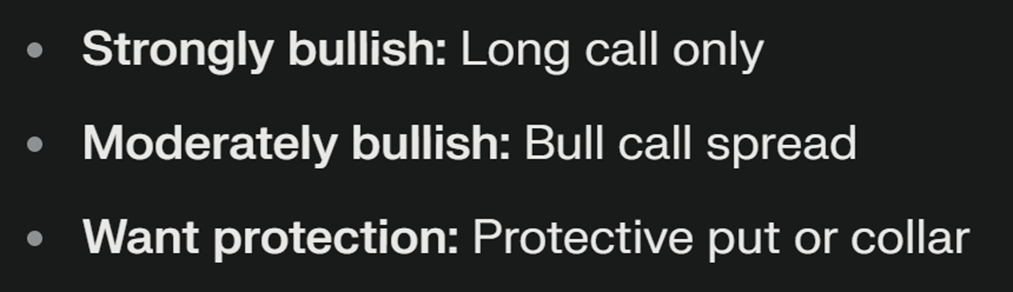

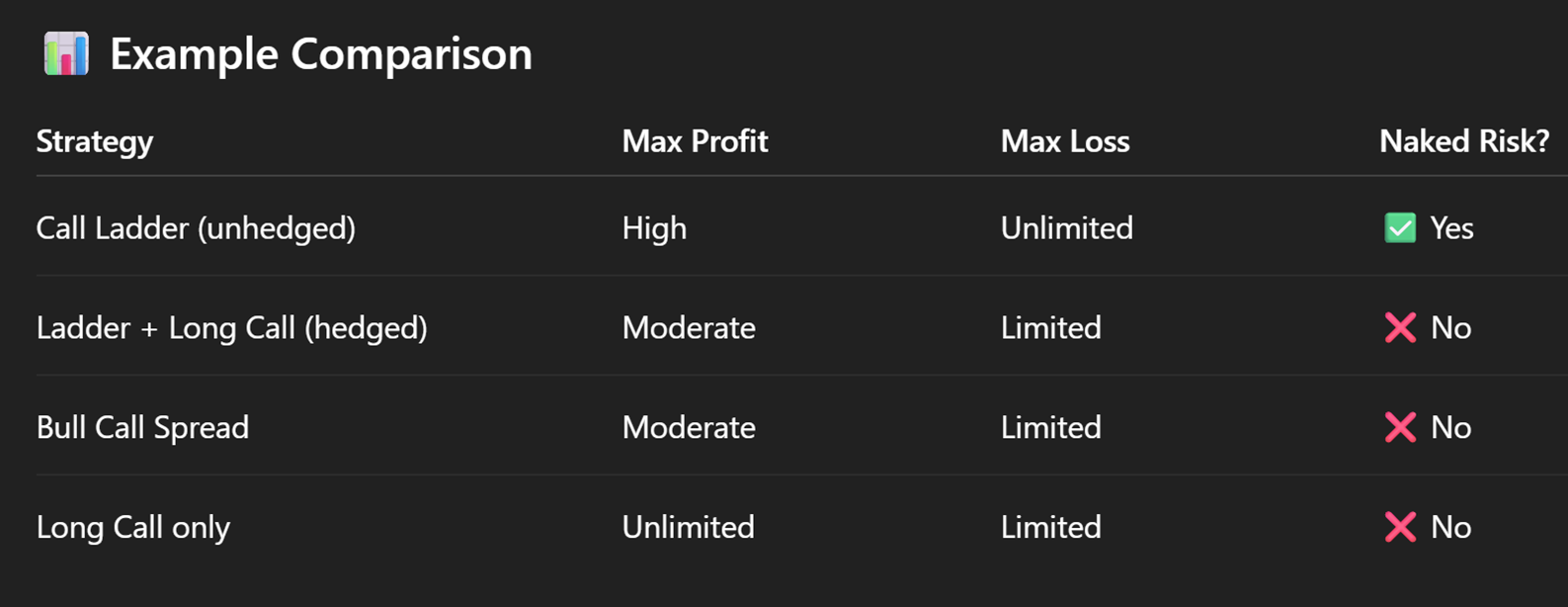

For long bull call is good

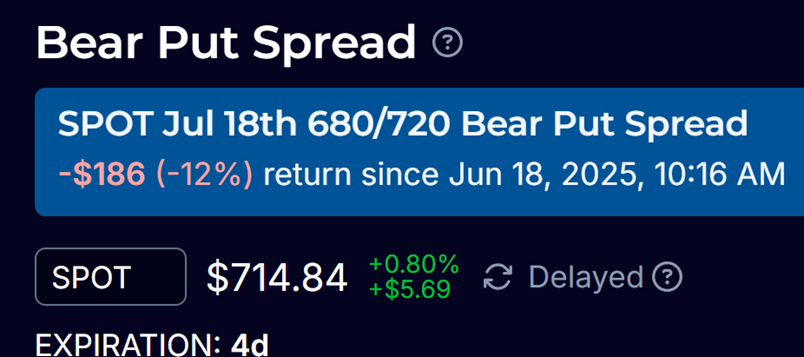

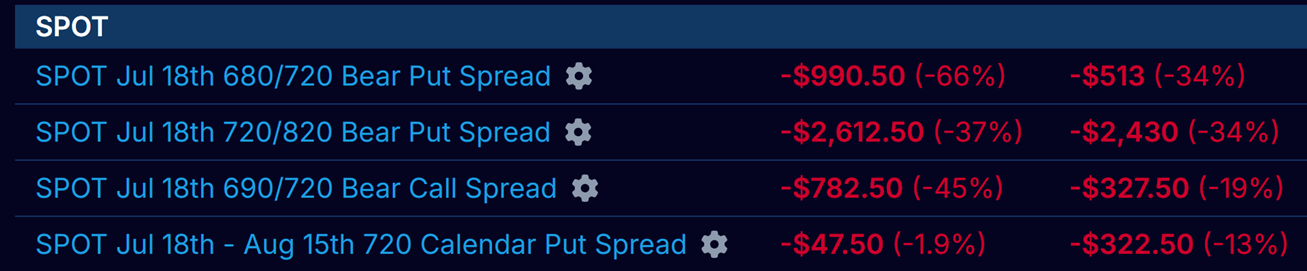

Fot short bear put is good

On Jun 20

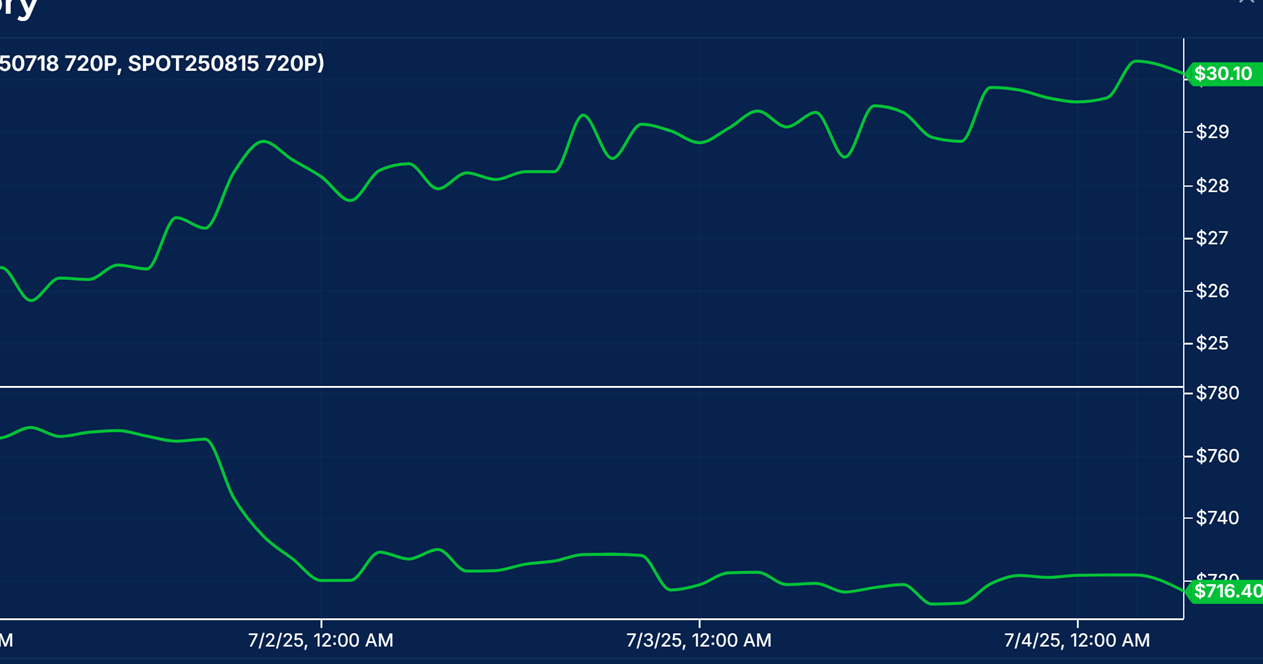

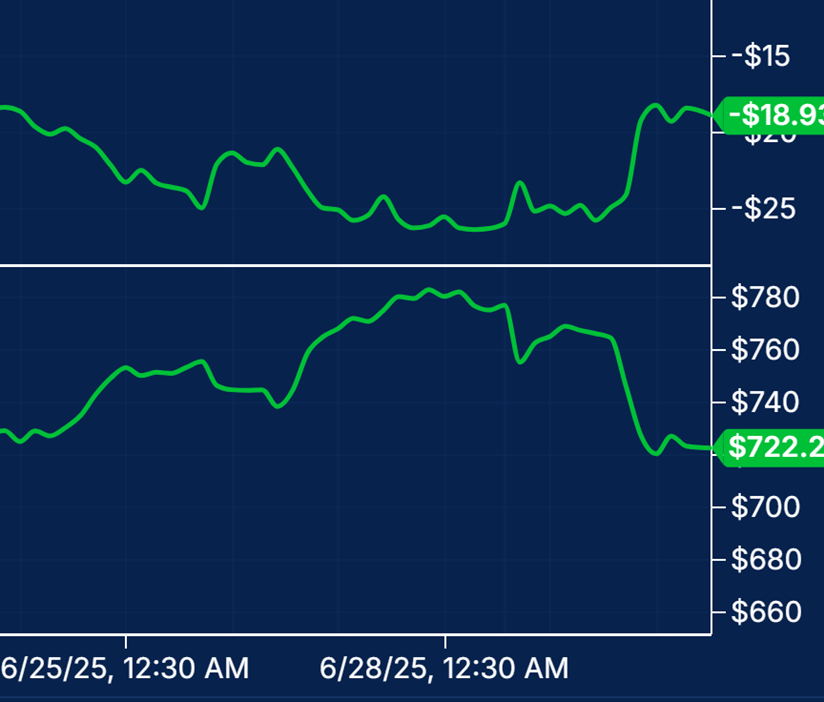

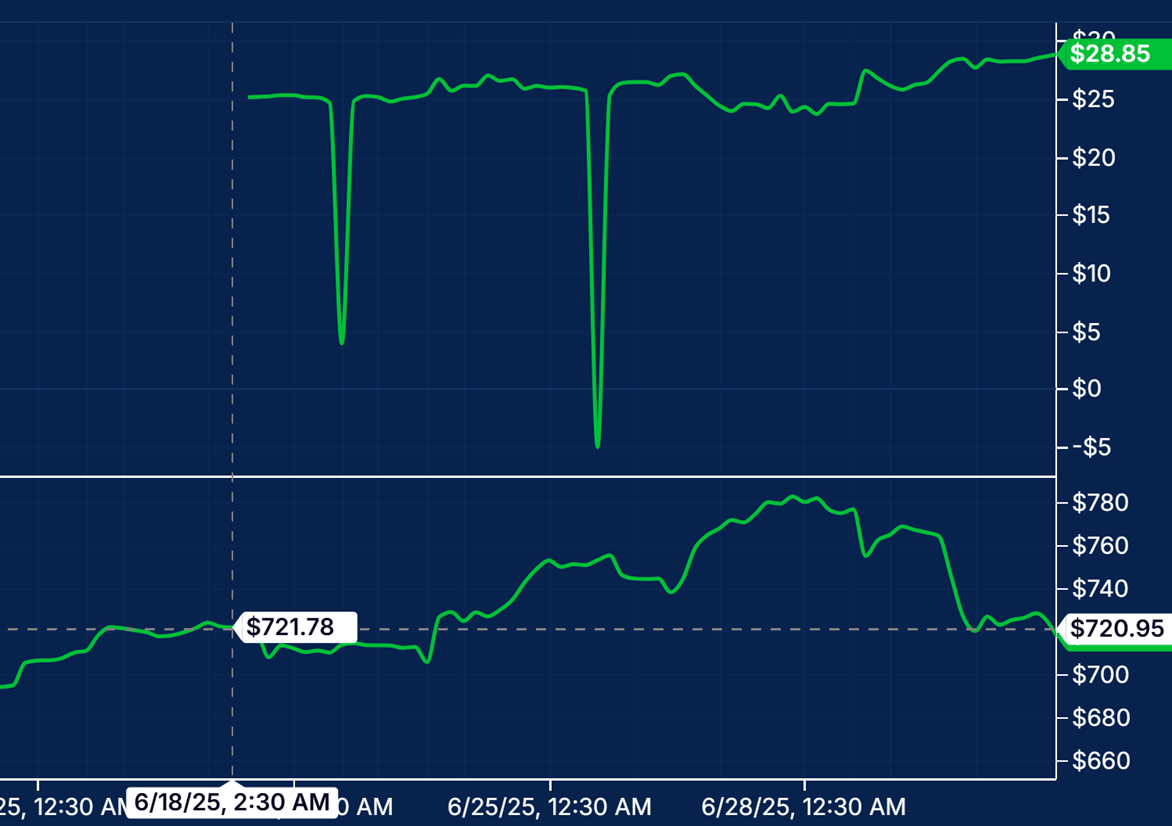

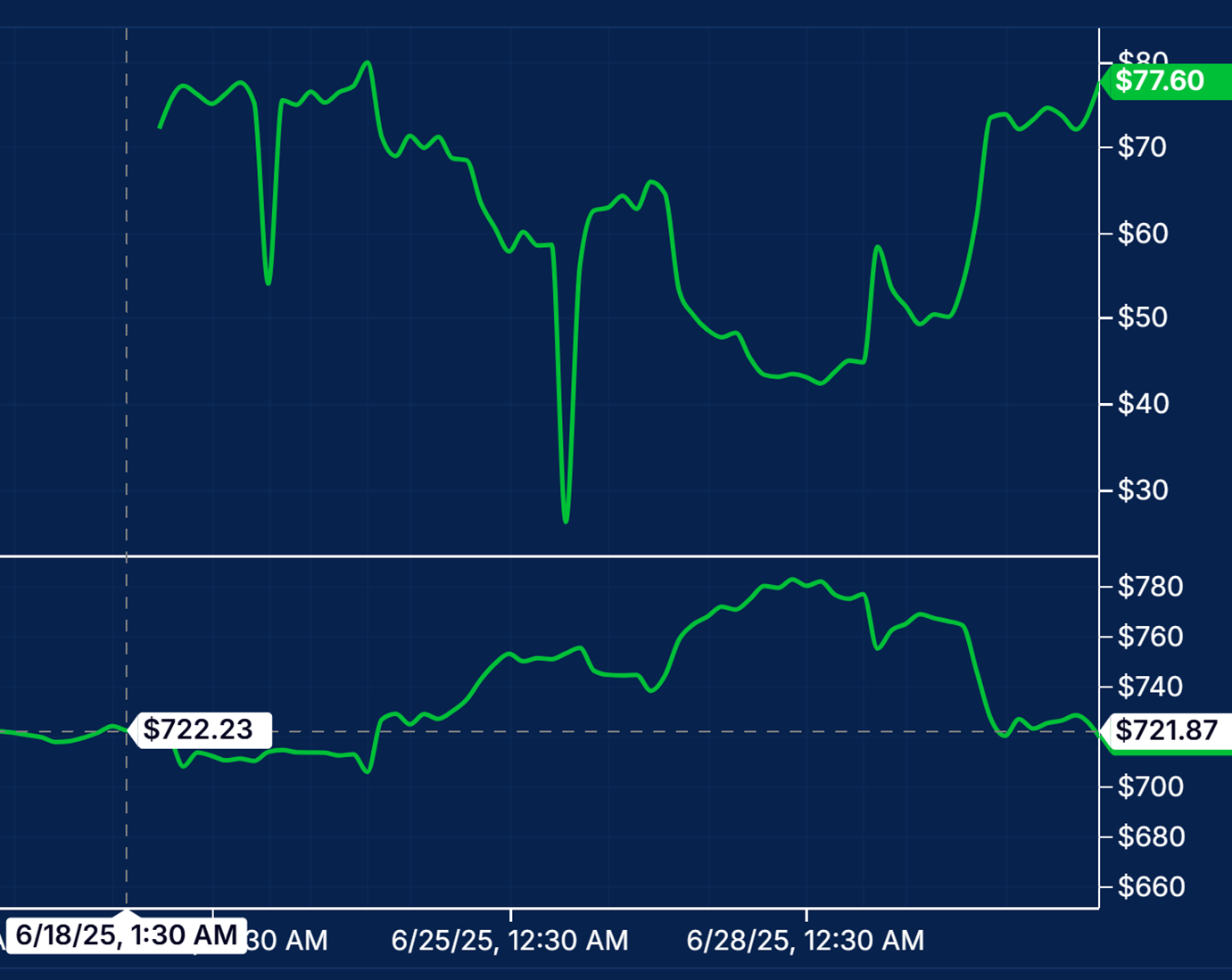

$776.05 on 27th Jun

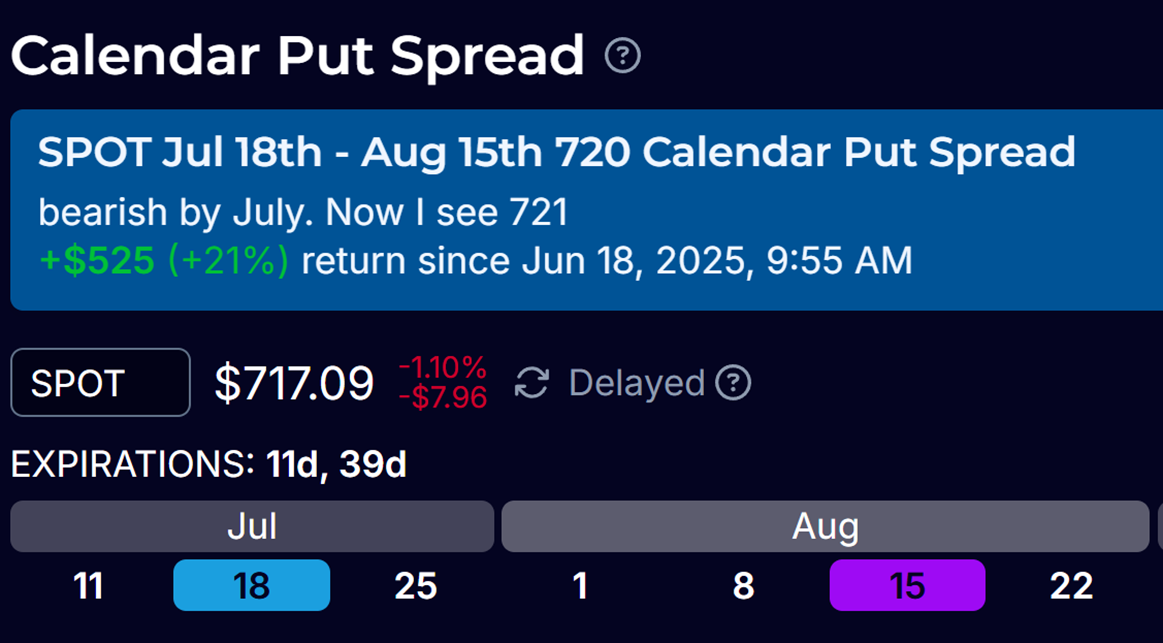

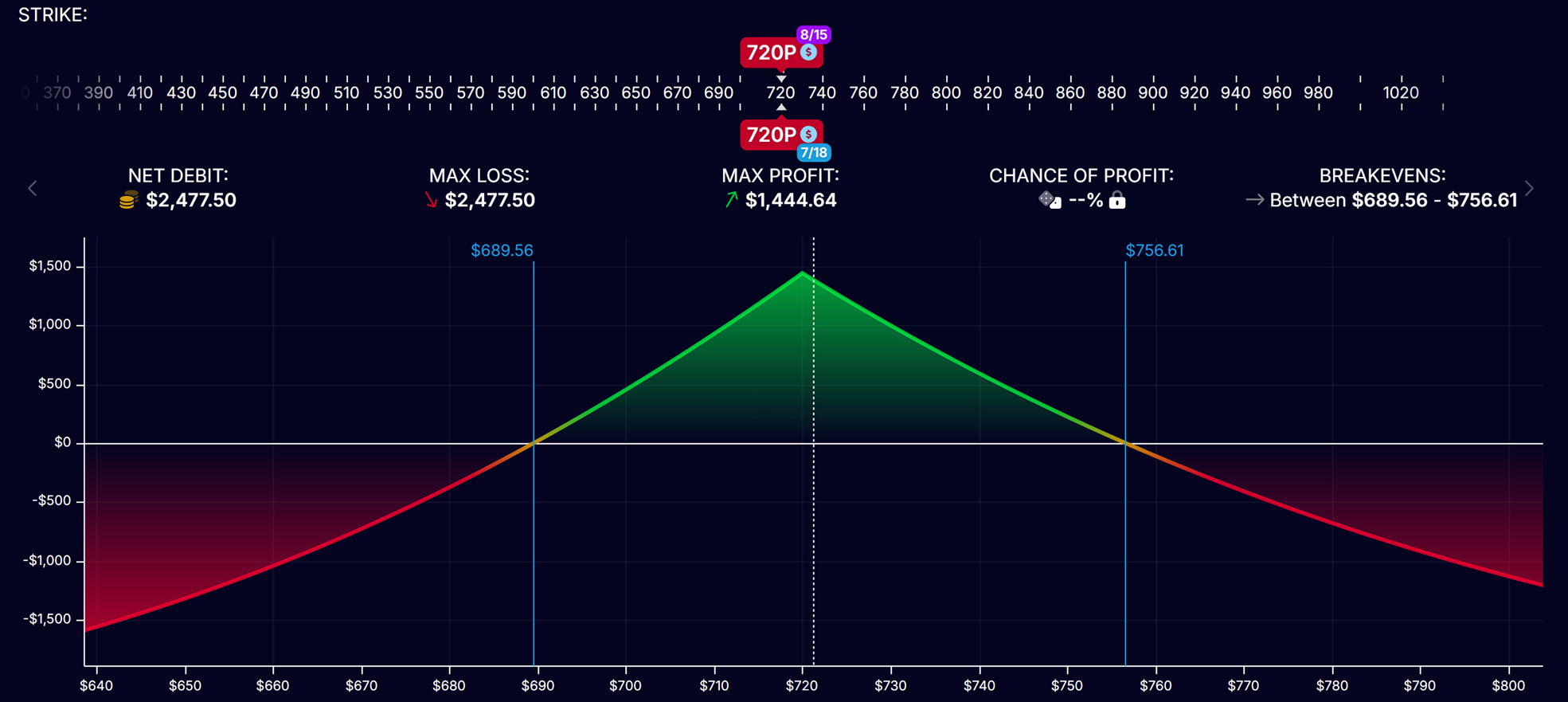

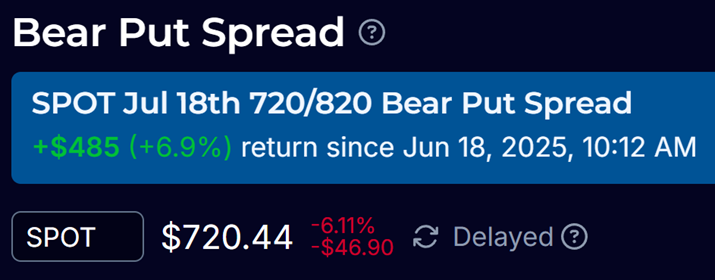

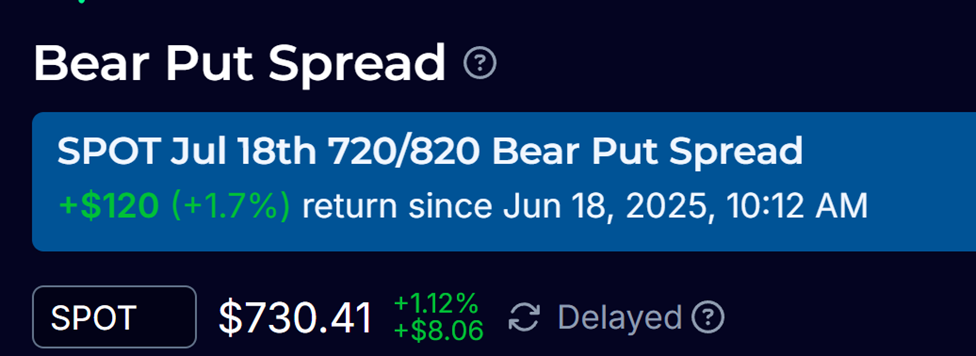

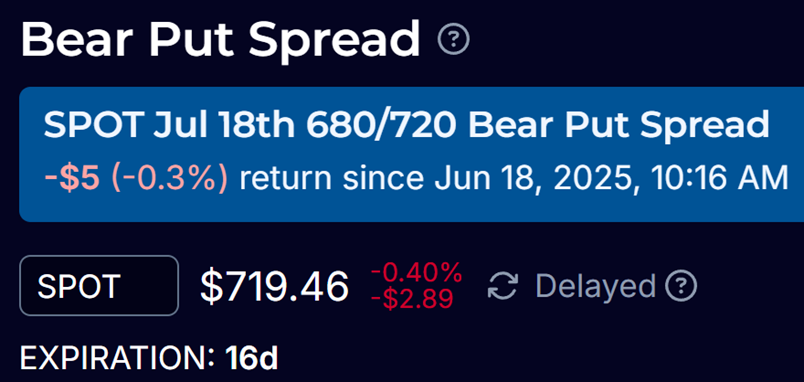

SPOT $720 on 2nd July

SPOT $720 on 2nd July

SPOT $722 on 2nd July

|

|

|

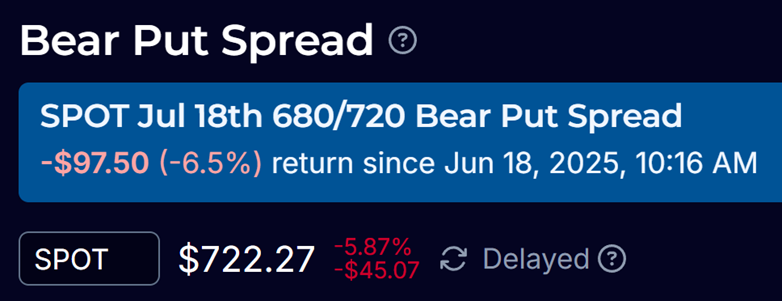

SPOT $730 on 2nd July

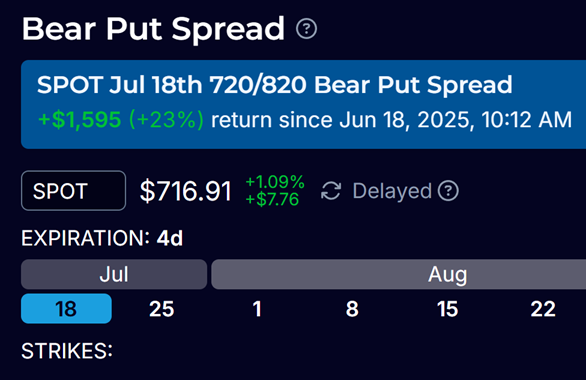

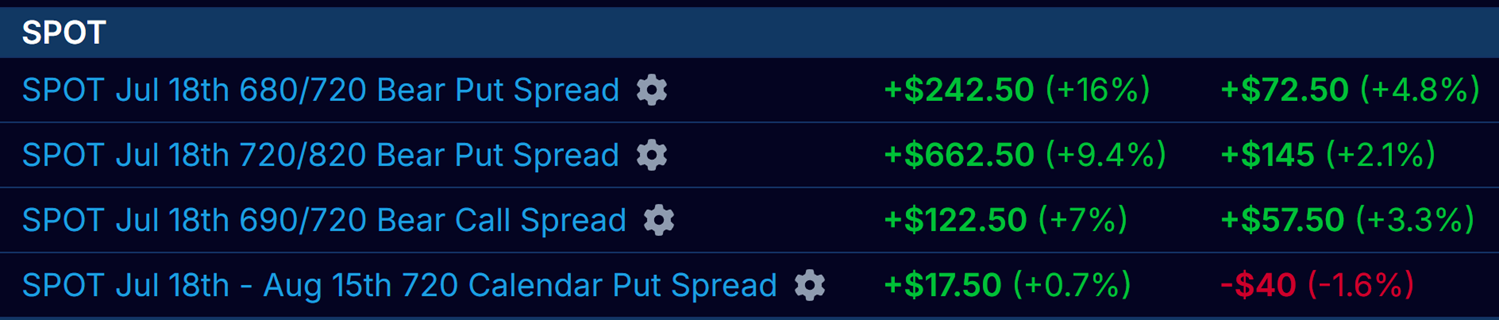

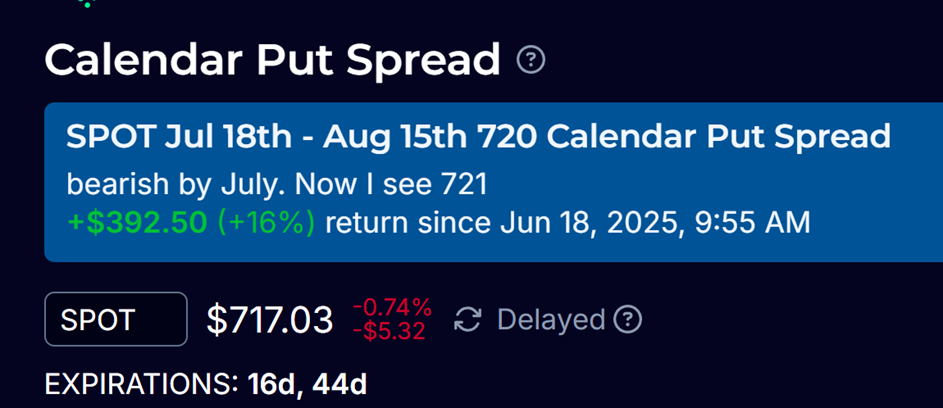

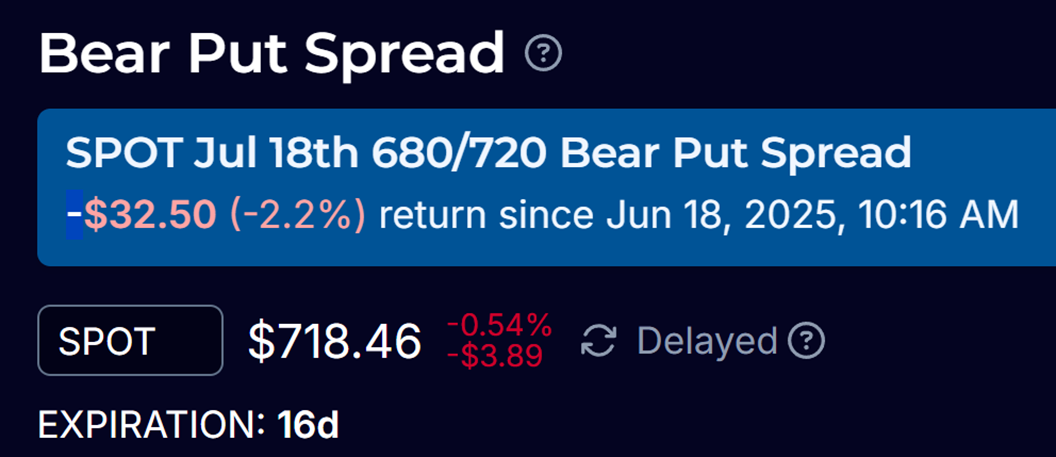

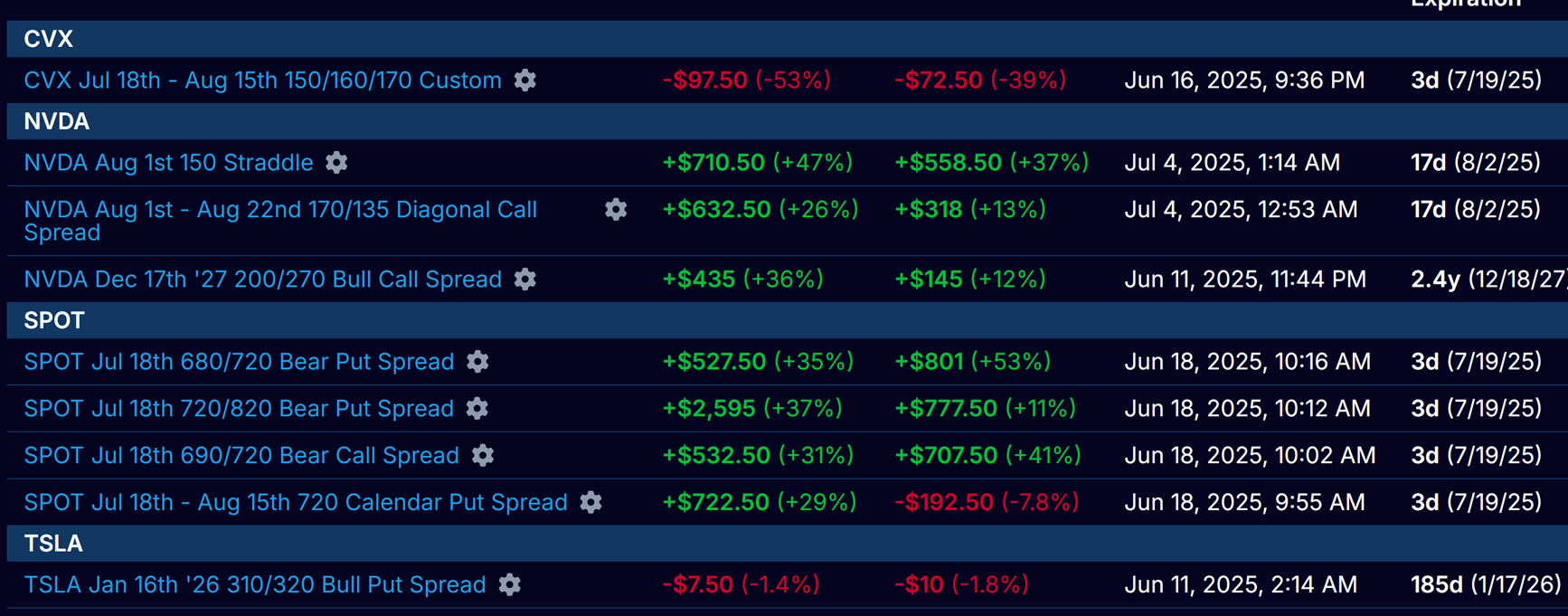

Did you check why 720/820 is giving less profit but why calender put is giving high profit and its margin is also less ?

|

|

|

Check the Theta my sold is Higher than the my bought which is going to expire after a month

I will get more benefit in next few days since I received

high premium of 30 USD

This is very safer. Though the price went into opposite direction in the

previous week,

still my profit margin is not very much affected. It went to

780 as well. But I am not affected

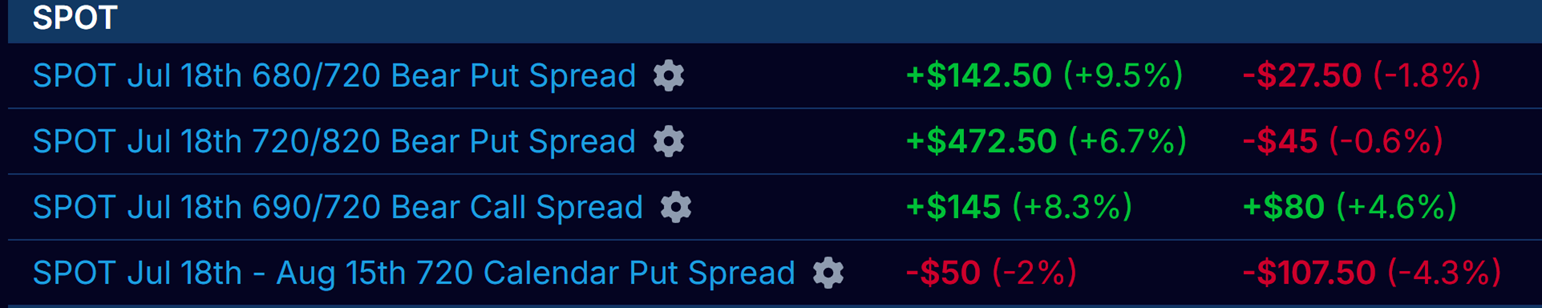

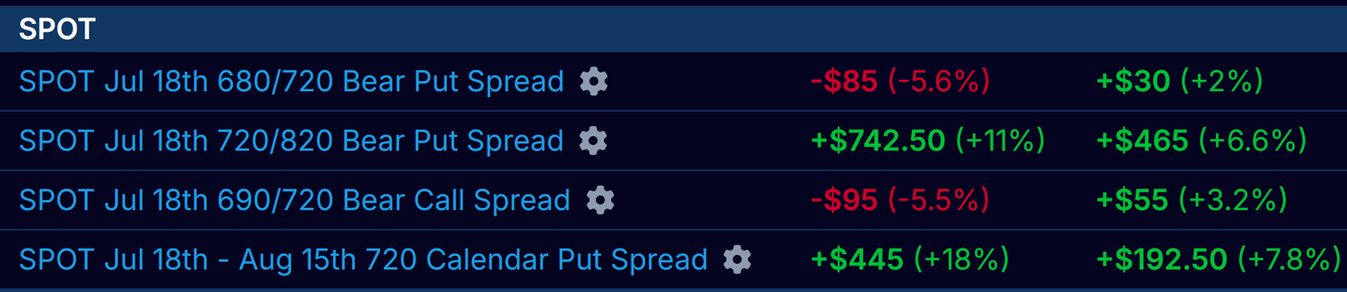

Did you check why 720/820 is giving profit but why 680/720 is not giving ?

|

|

|

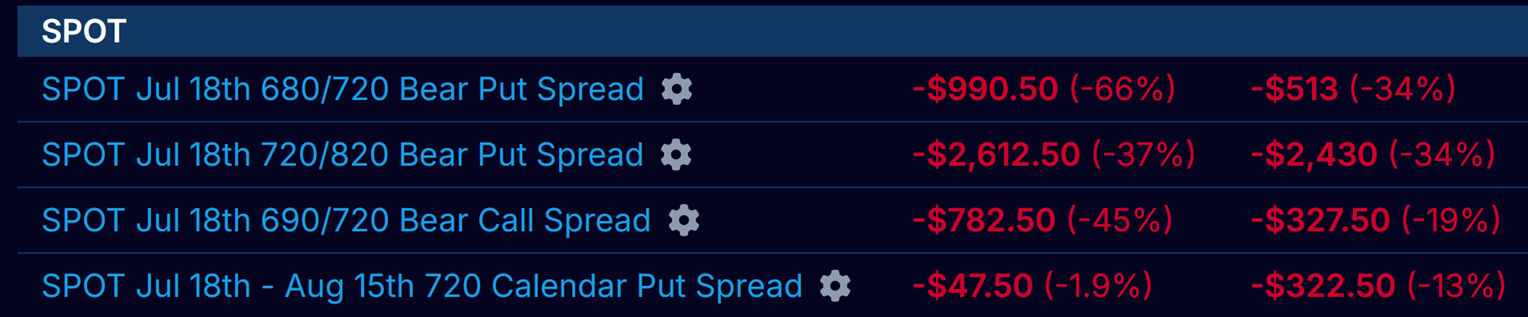

It was high risk when SPOT price was higher in previous weeks.

See this example. It was giving higher Loss also when it was

in opposite direction

$776.05 on 27th Jun

$720 on 3rd July

|

|

|

|

|

|

SPOT $714 on 3rd July

|

|

|

|

|

|

|

|

|

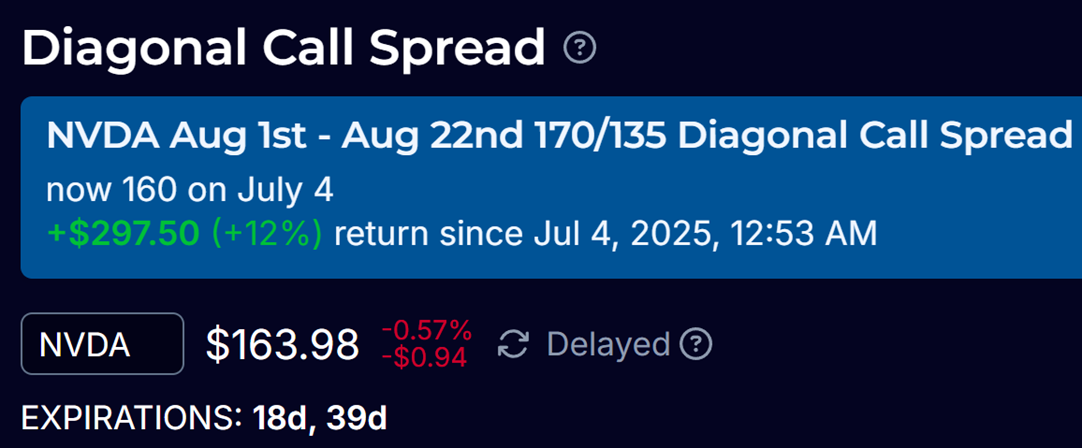

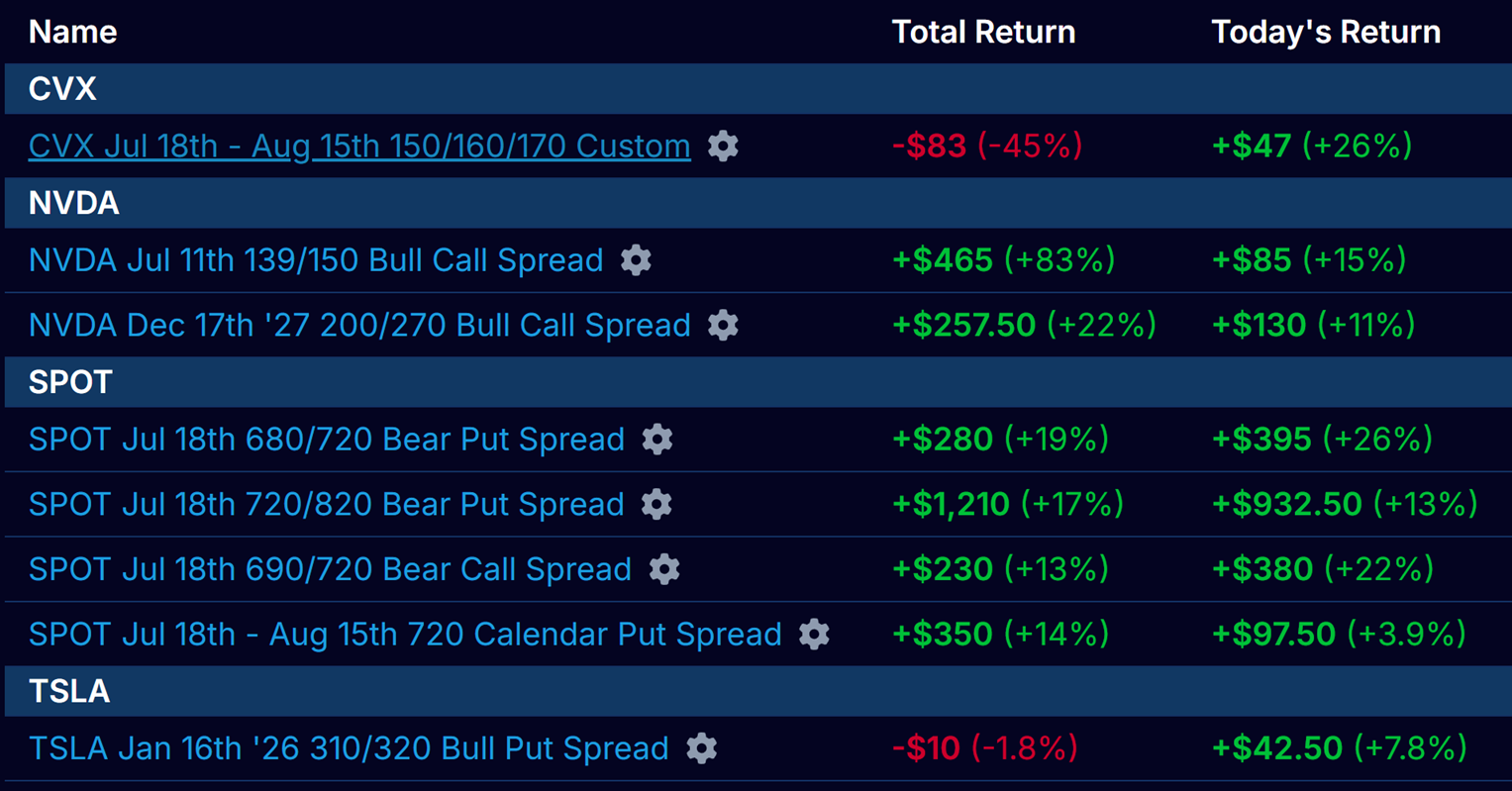

There is a downside in this hedge sell of 150C

Instead I should have considered either no edge or buy 130P for downside

protection (protective put)

On Jun 11, it was 1.53 only. I would have got 21 Ė 9 Ė 1.5 = 10 USD. It means

1000 USD profit

I would have sold 150C early since it is on sale side too risky.

SPOT $717 on 7th† July

|

|

|

|

|

|

|

|

|

|

|

|

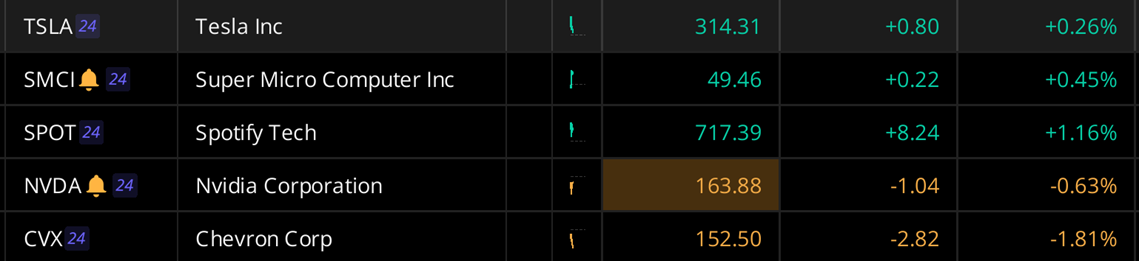

July 10 NVDA 163

July 10 NVDA 163

On July 14

|

|

|

|

|

|

|

|

|

|

30 Ė 14 = 16 profit |

3 loss |

|

This is high risk if you donít sell OTM 820P and if no volume and you donít have shares to deliver and you donít have margin to buy shares from the market |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 profit |

15 loss |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3$ profit |

It will go worthless |

|

|

|

|

|

|

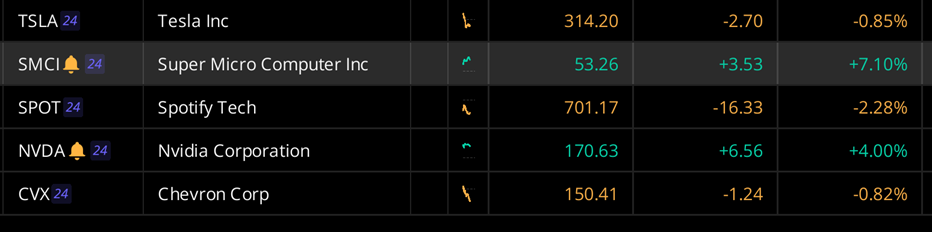

Compare the SPOT it was 701 in the AM now 710 in PM

|

|

|

|

|

|

|

|

|

|

|

|

|

8 profit |

1 loss |

|

|

|

|

|

|

July 24