https://optionstrat.com/QHPuCOgY54qe

|

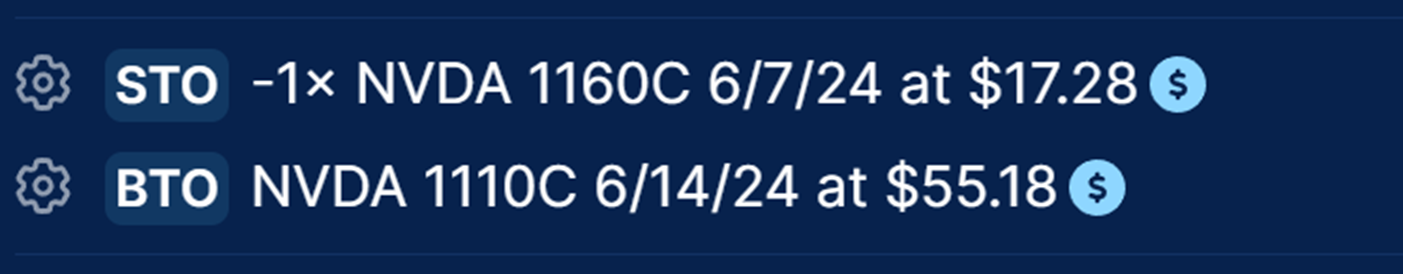

Diagonal Call Spread

Volume 546 OI 550 IV 71.9% Delta 0.578 Theta -2.40 Gamma 0.0037 Vega 0.583 Rho 0.123

SOLD NVDA 955C 5/24/24 Volume 6,785 OI 2,744 IV 139% Delta -0.496 Theta 9.82 Gamma -0.0041 Vega -0.280 Rho -0.0238

|

50 + 33 = 83

50 - 35 = 15

104 82 = 22

22 15 = 7$ profit

Delta : .835 - .783 = .052

55 17 = 38

87 36 = 51

94 42 = 52

6th Jun 140 87 = 53

Jun 5 9.42 1183

Jun 5 9.42 1183

Jun 5 10.07 1192

Jun 7 10.12 1192

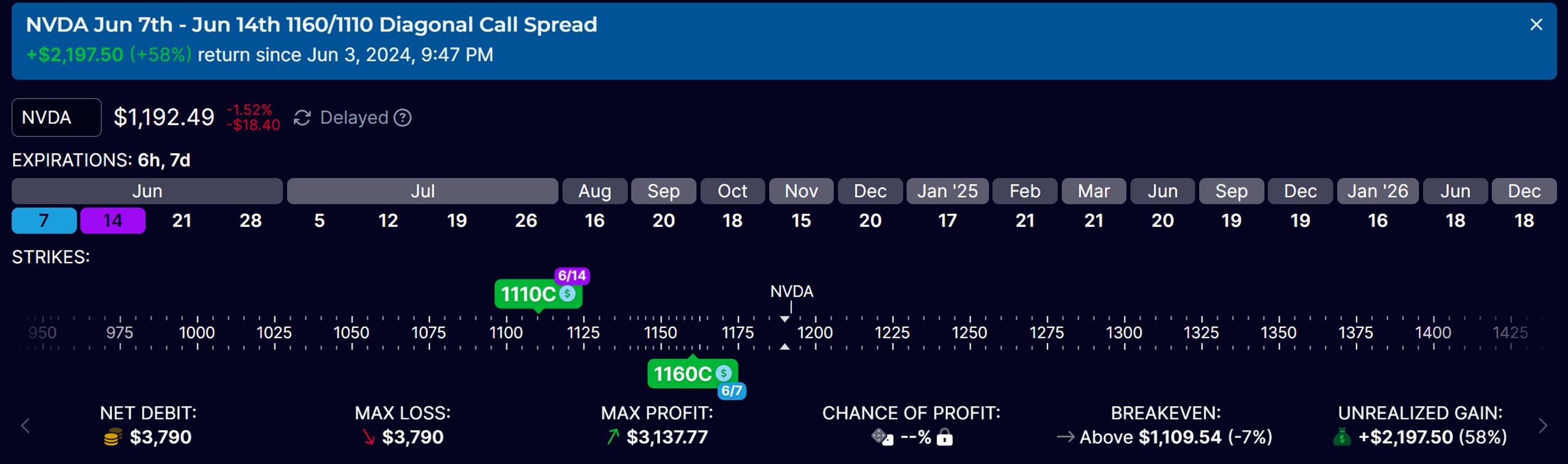

3RD JUN INVESTED 3800

7TH JUN GAIN 2200 60% PROFIT WITHIN THIS WEEK

1110C

On 8th Jun 2024 Saturday

1207 current spot -1160 strike price = 47 closing price

1207-1160 17 selling price = 30 loss

106 current call price 55 buying price = 50 net profit

Net profit : 50 profit 30 loss = 20$ profit for the investment of $38 = 53% profit

55 buying price 17 selling price = 38 invested