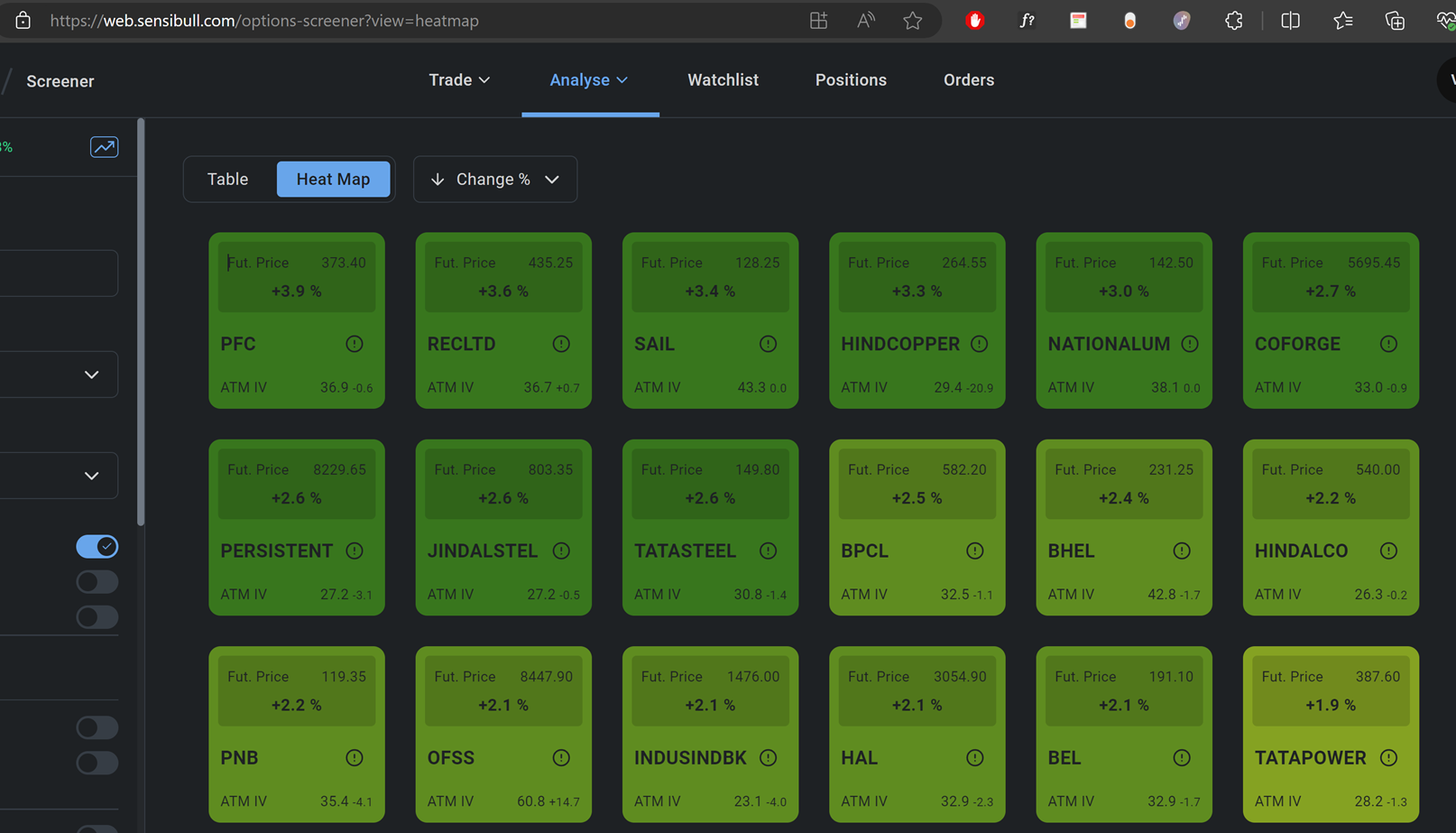

Implied Volatility (IV): It shows how much the market expects the price of an asset to change.

High IV means bigger price swings; low IV means smaller swings.

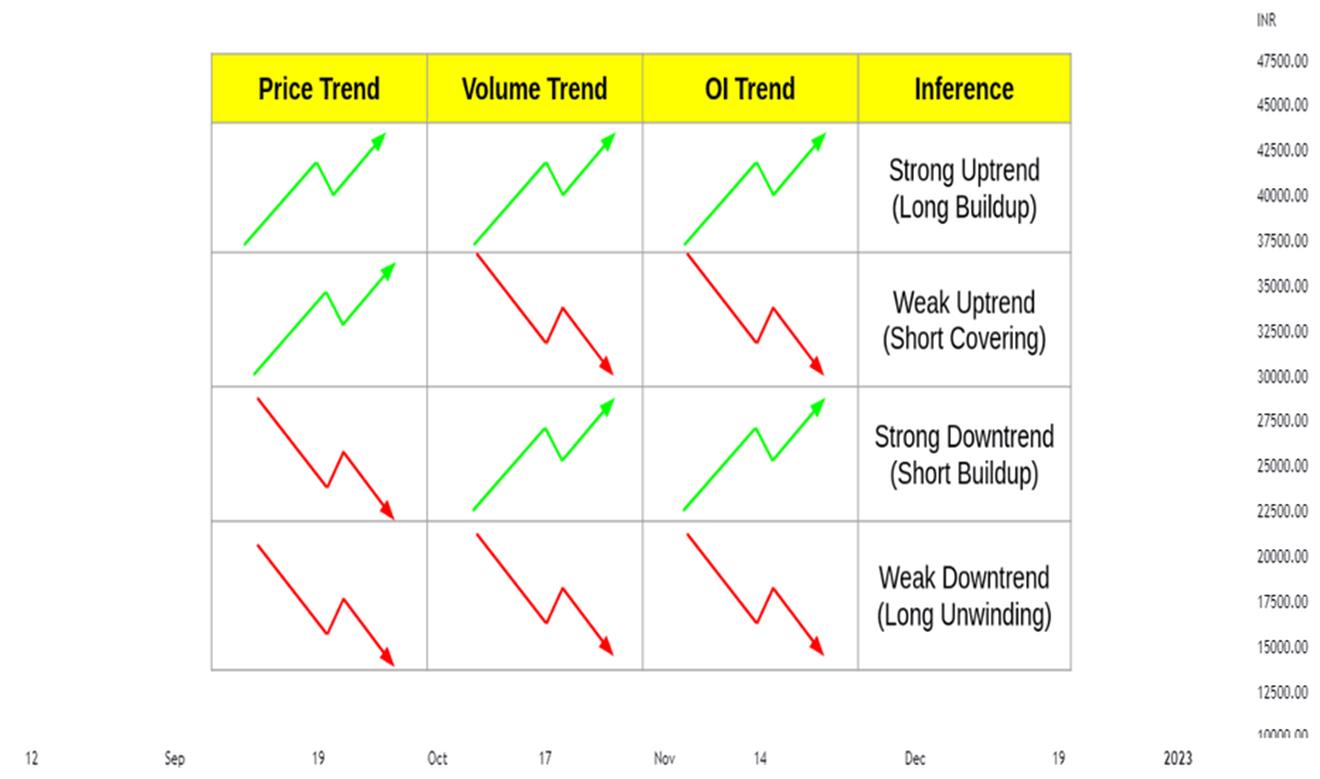

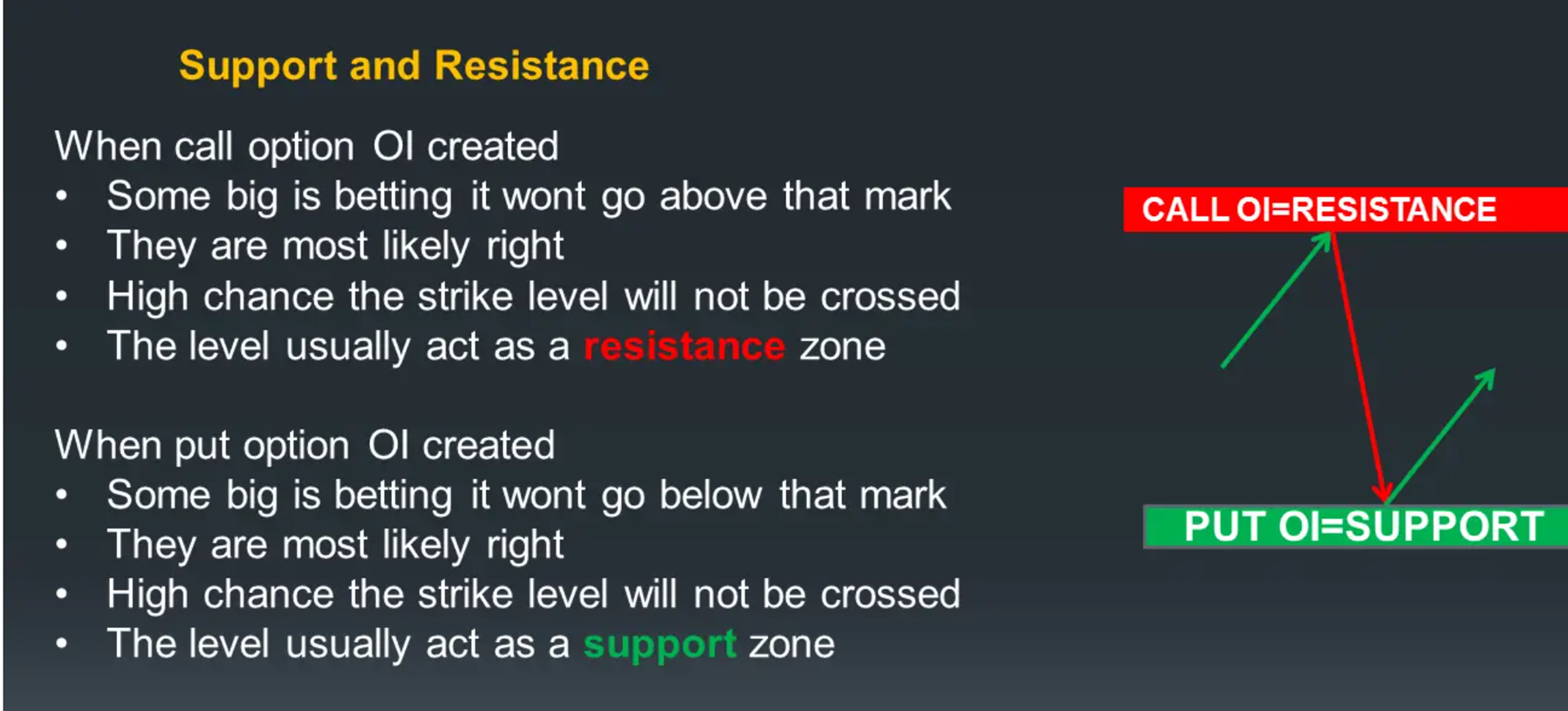

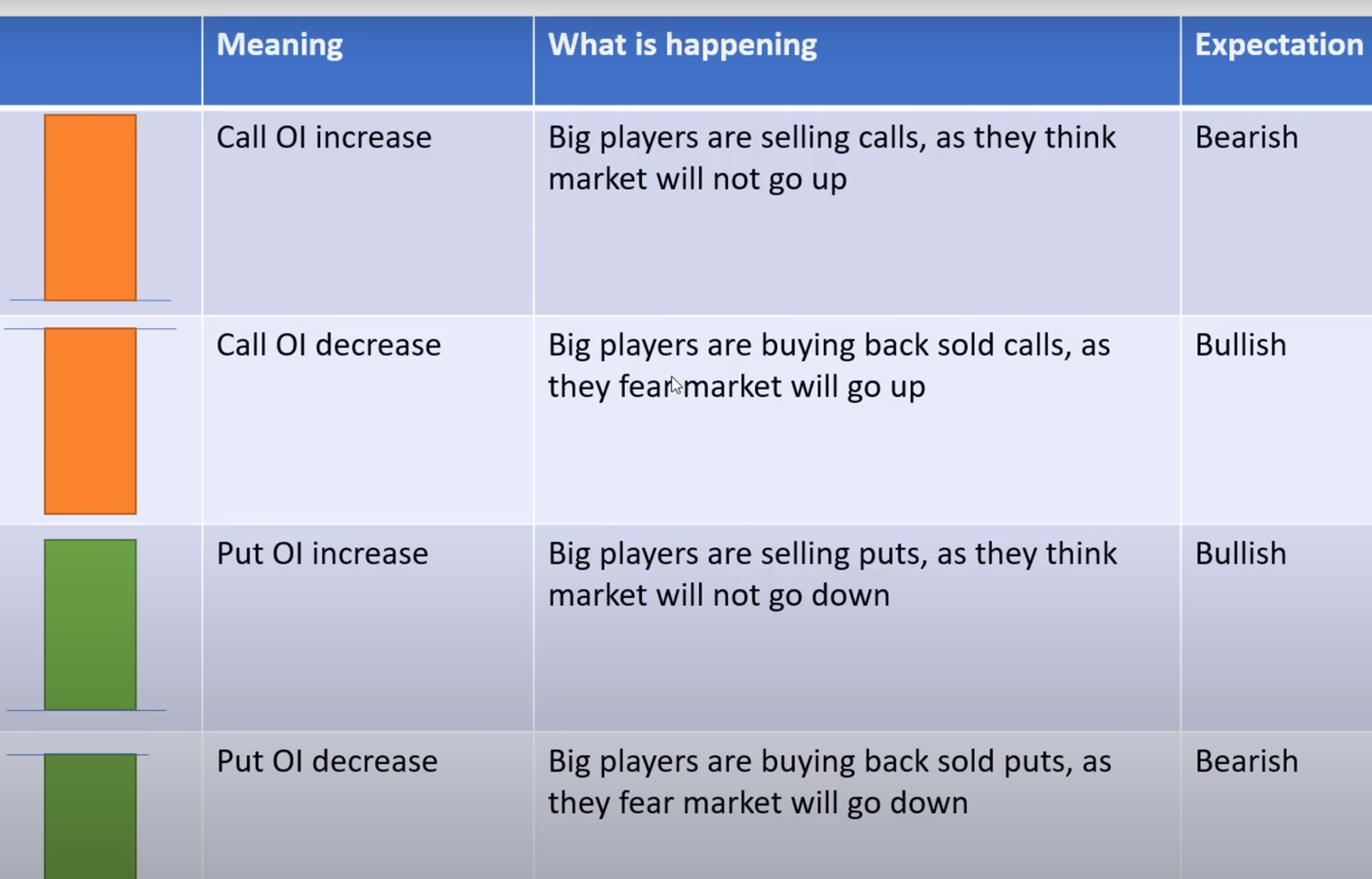

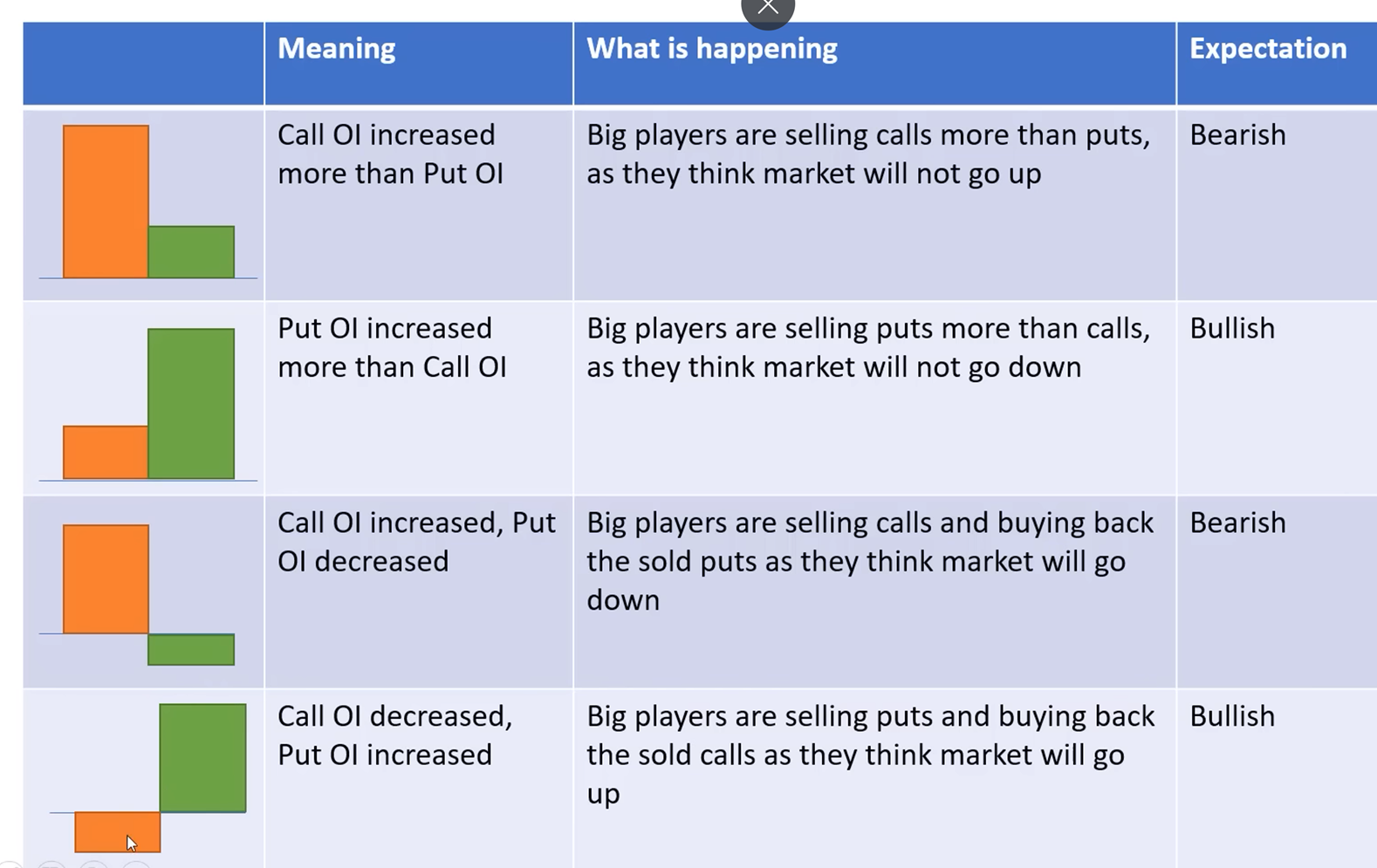

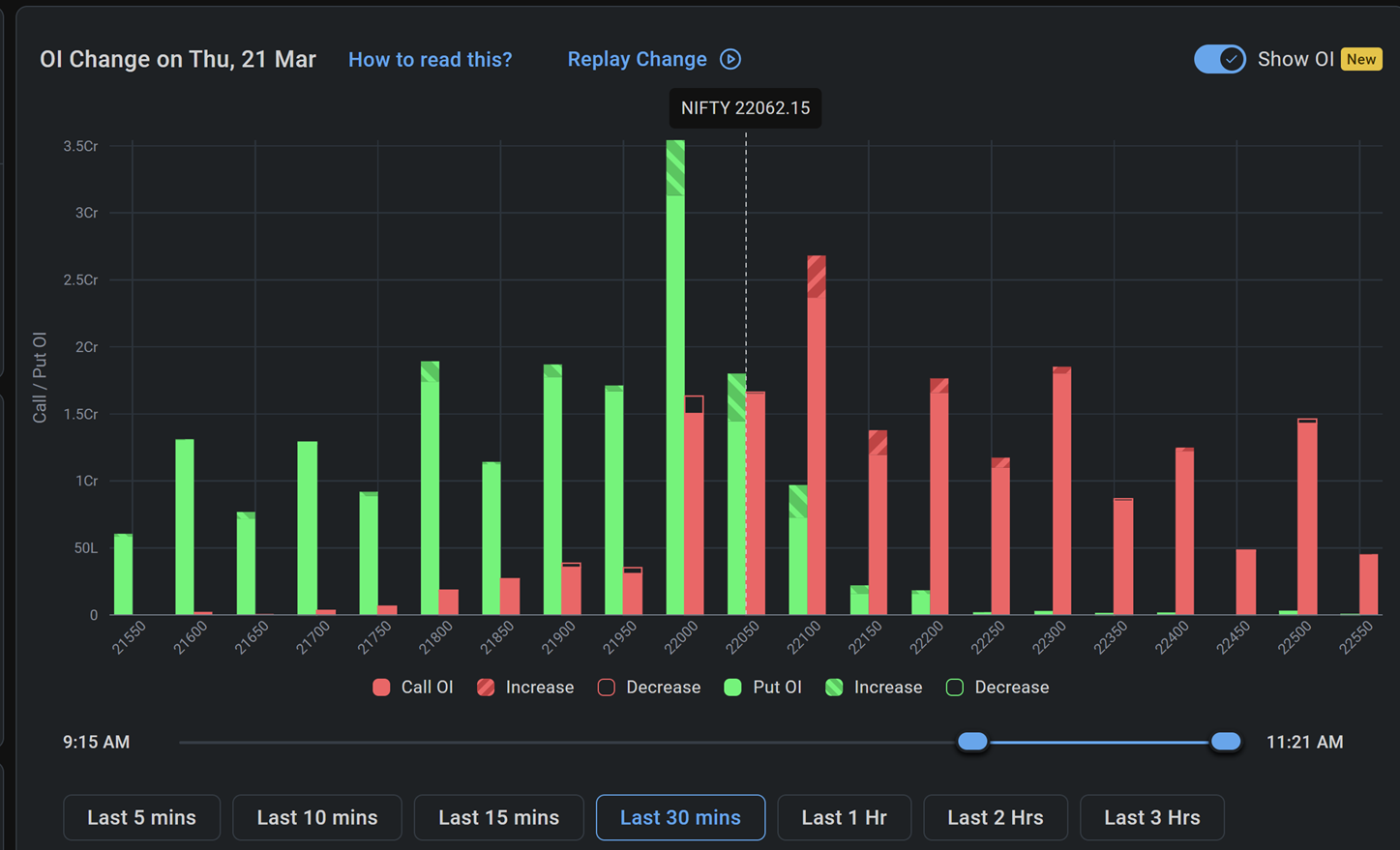

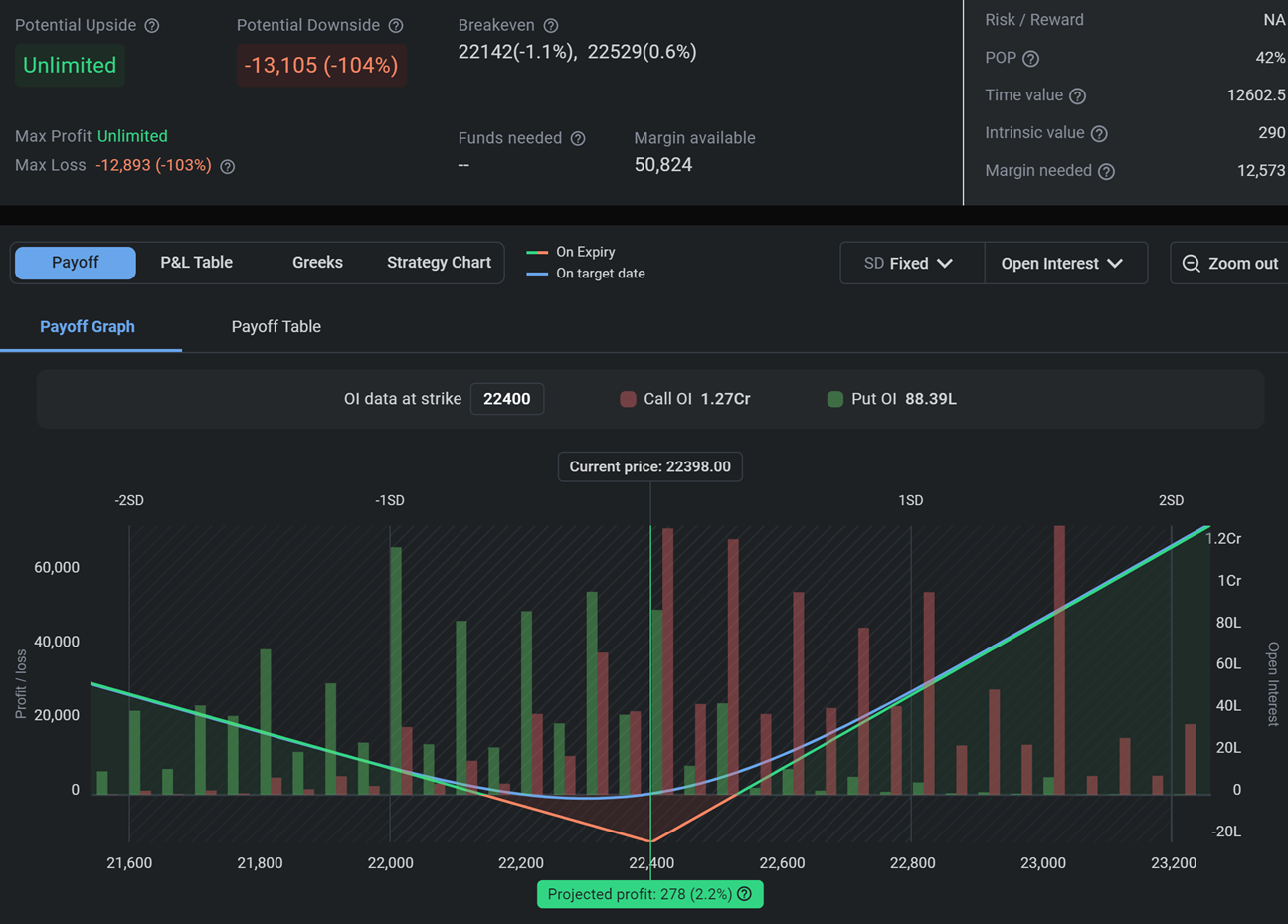

Open Interest (OI): It represents the total number of open (unresolved) option contracts.

Higher OI indicates more active trading in that option.

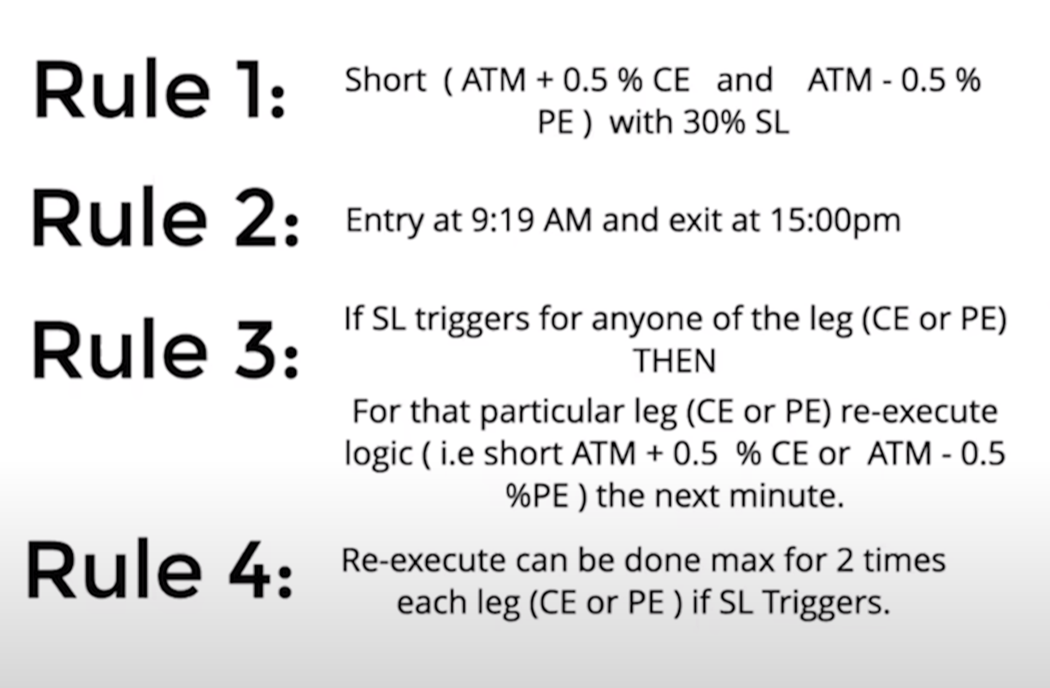

HOW COME THE SAME RULE APPLIES TO BOTH CALLS AND PUTS ? IS IT CORRECT ?

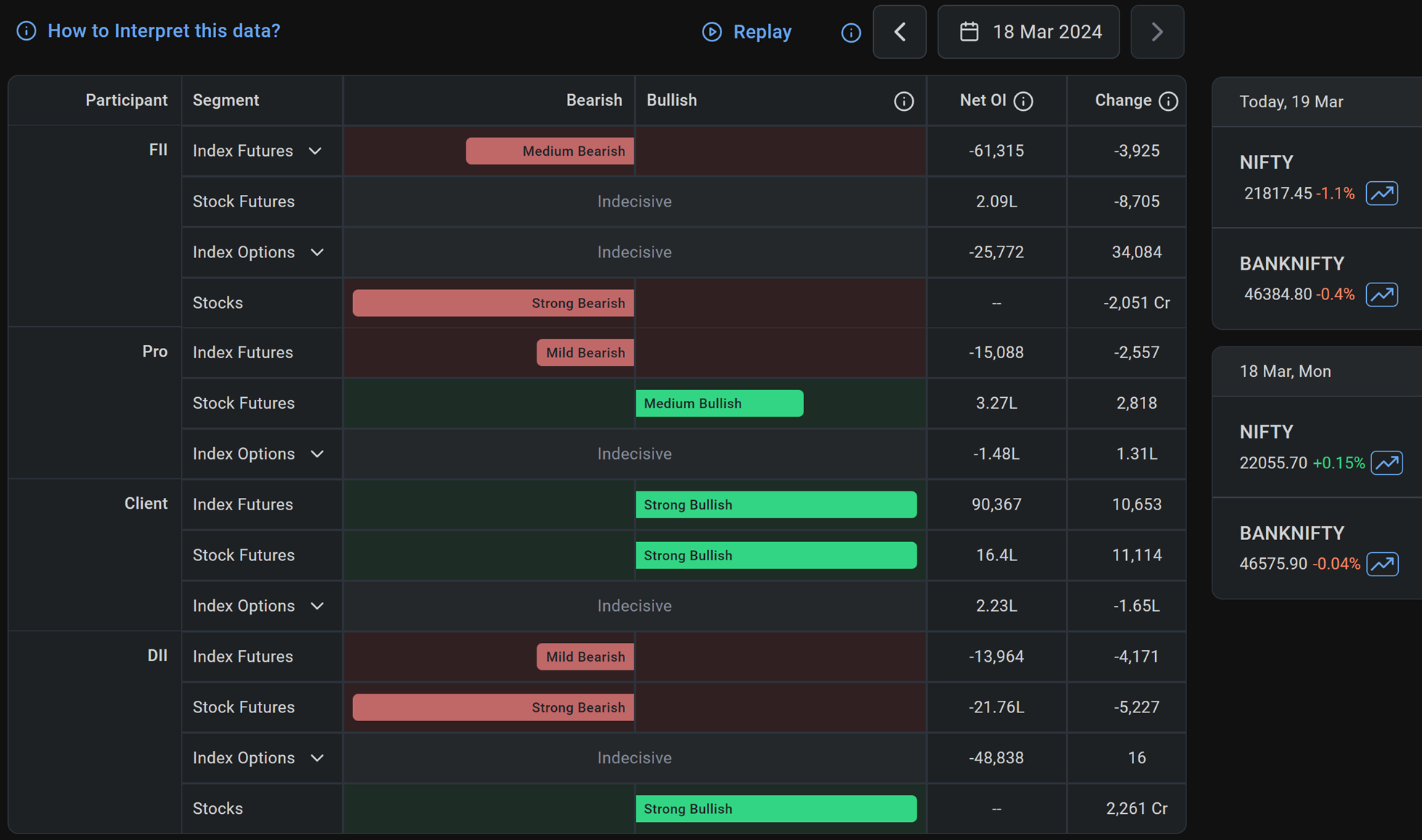

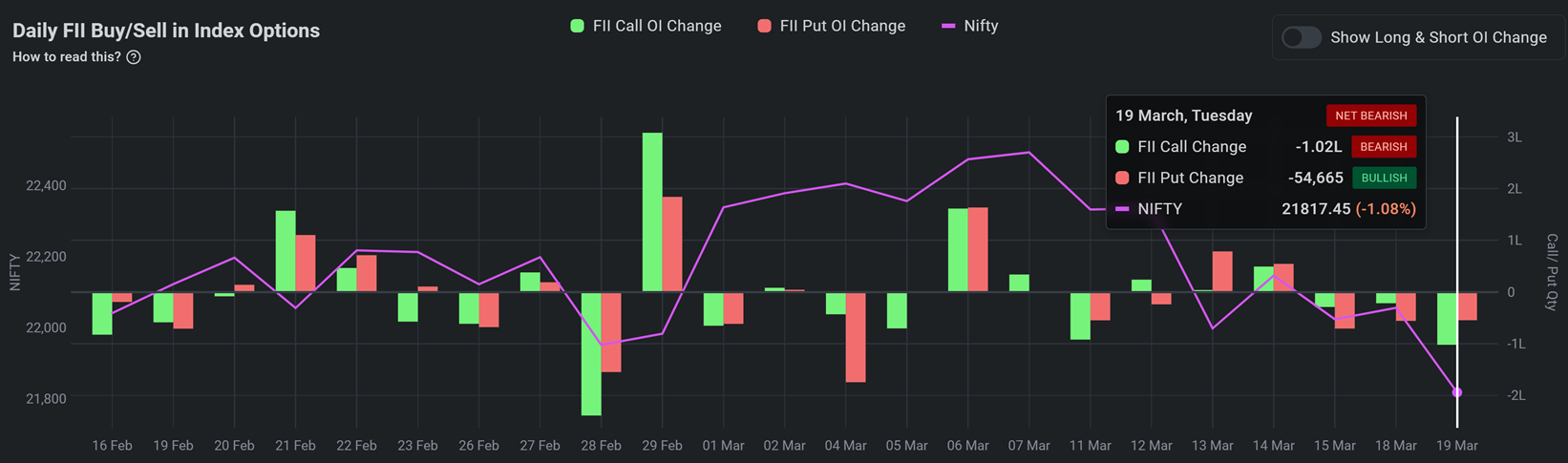

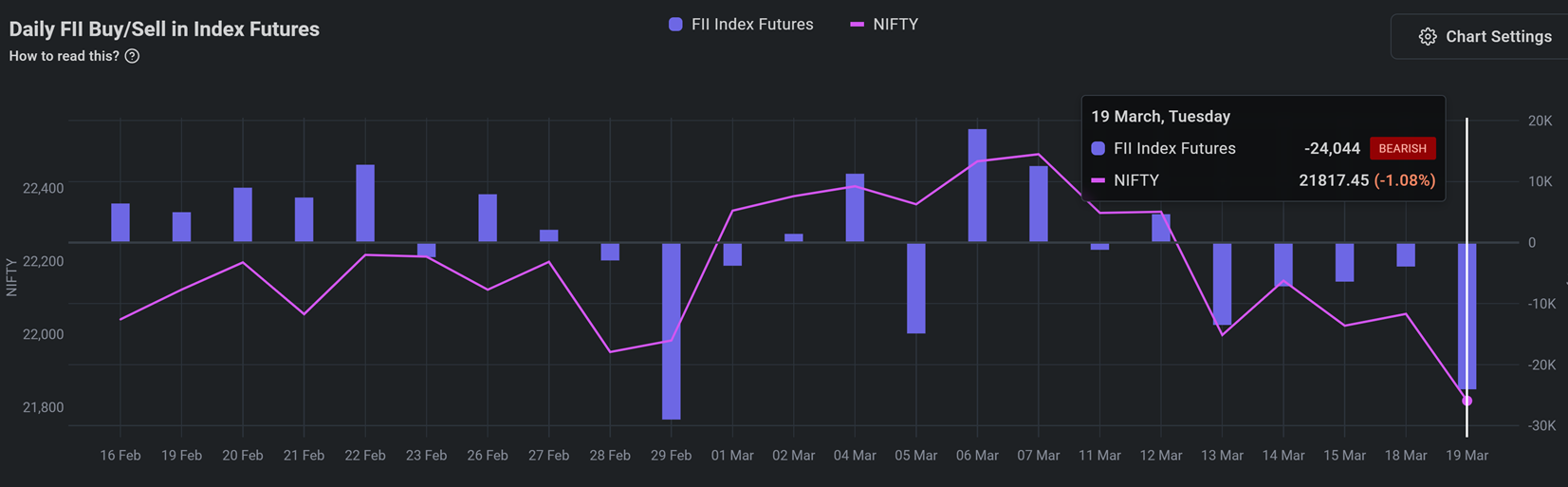

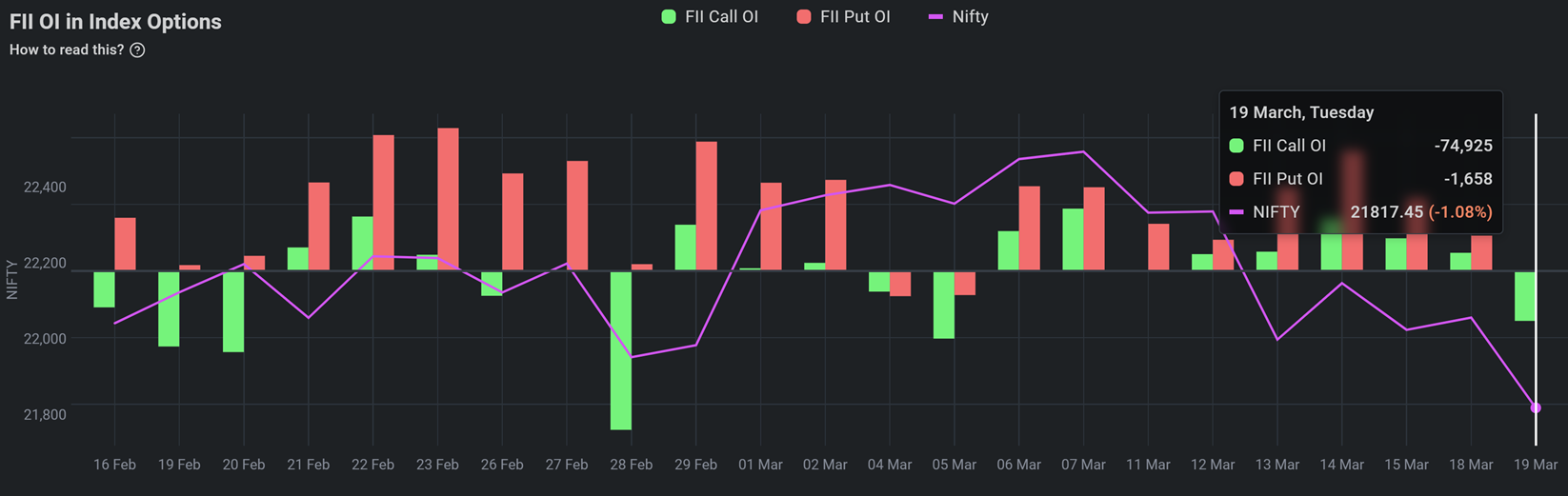

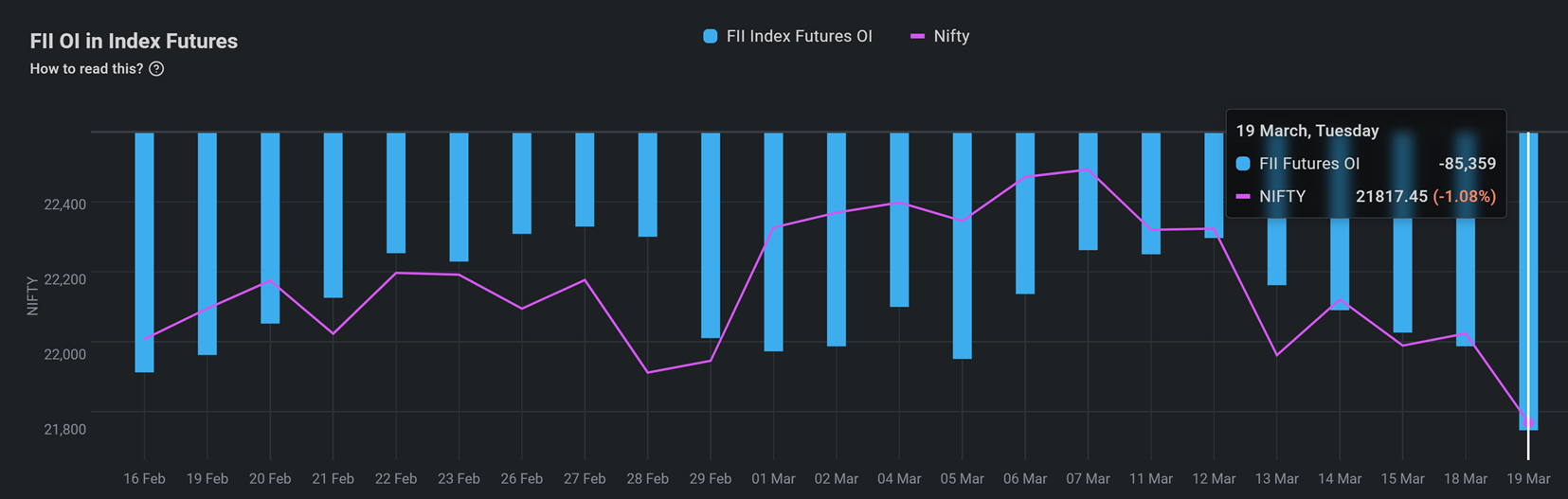

· If FII is bullish in Options and Futures, and Retail is bearish in Options and Futures, the market is expected to go up.

· If FII is bearish in Options and Futures, and Retail is bullish in Options and Futures, the market is expected to go down.

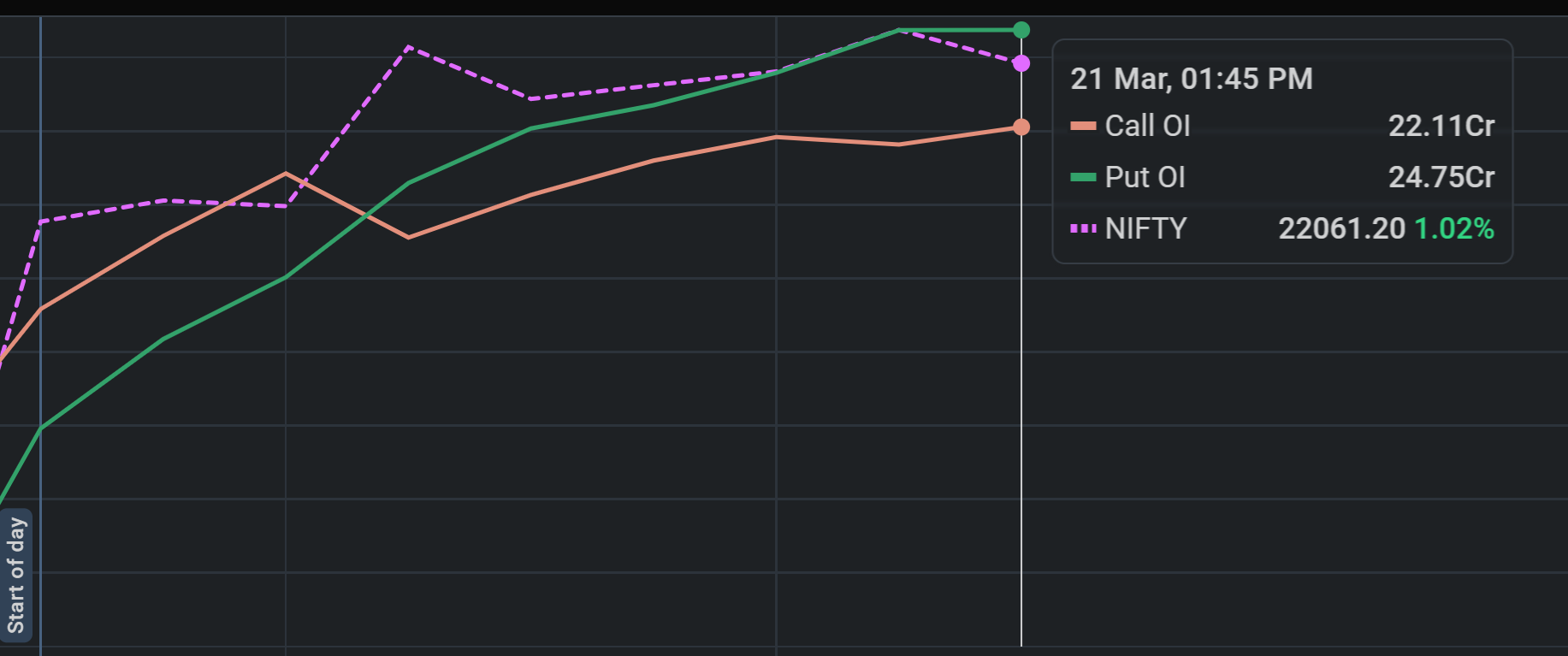

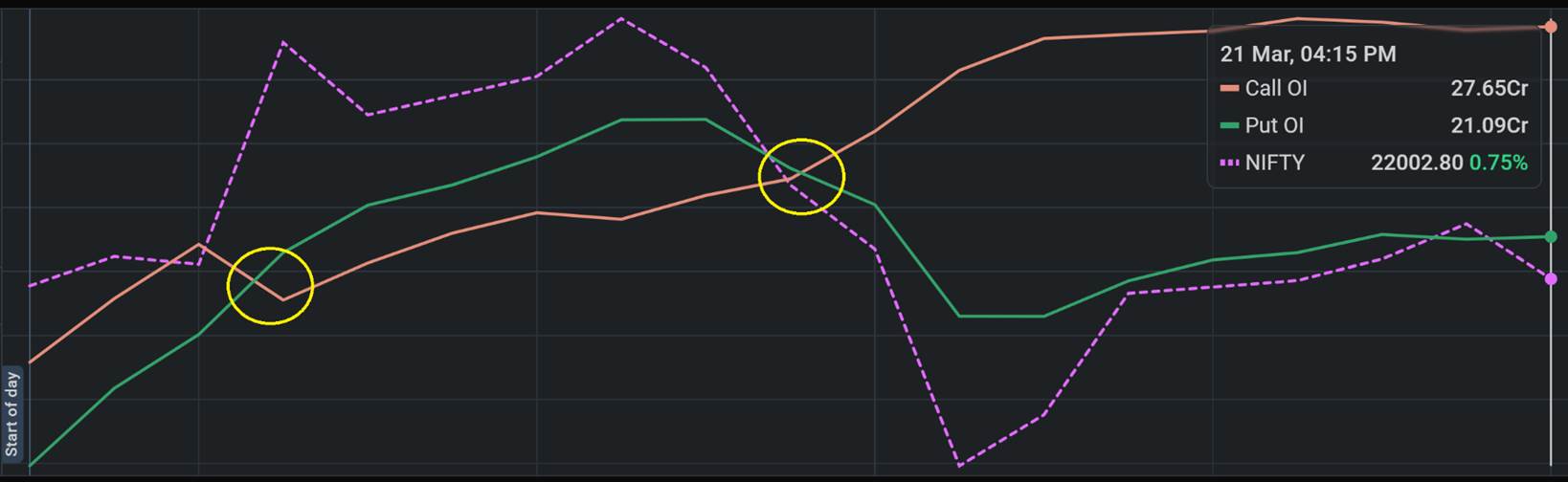

Open Interest Options cross

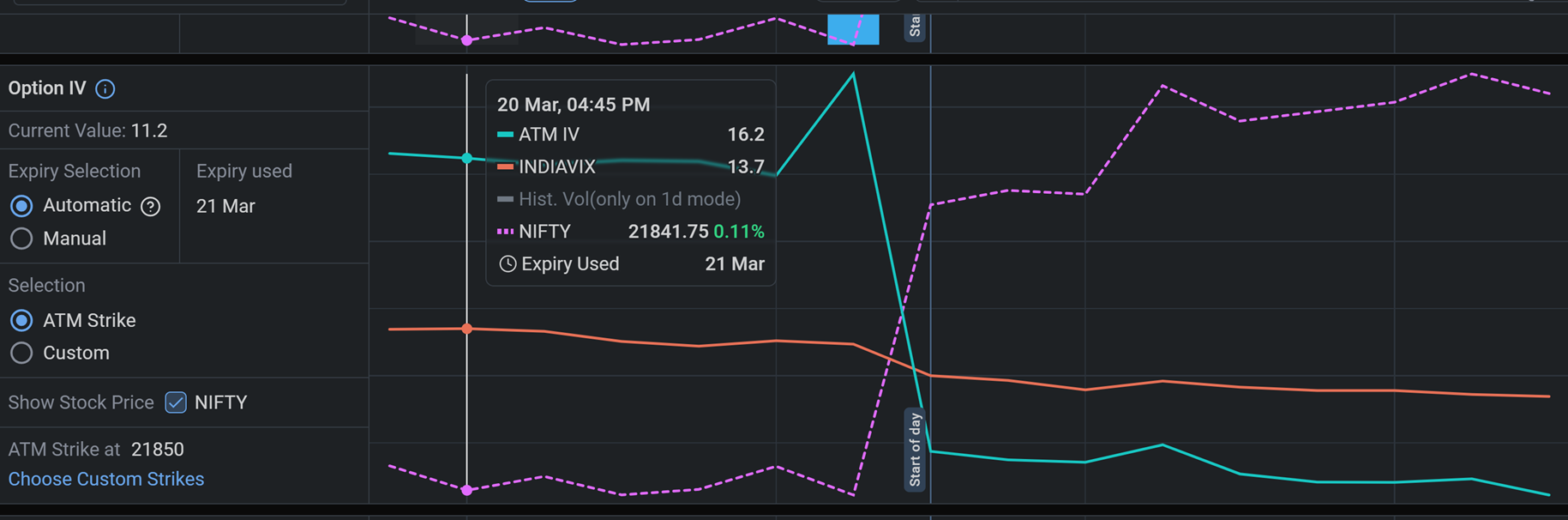

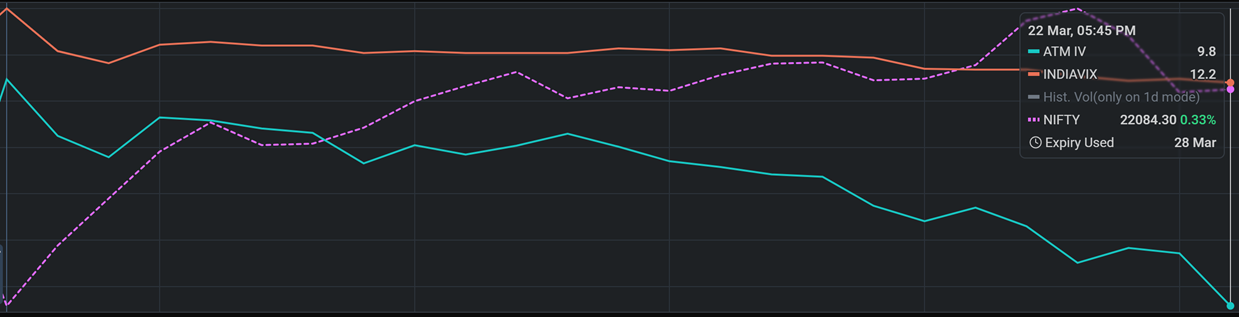

Open IV reduced drastically on the expiry date

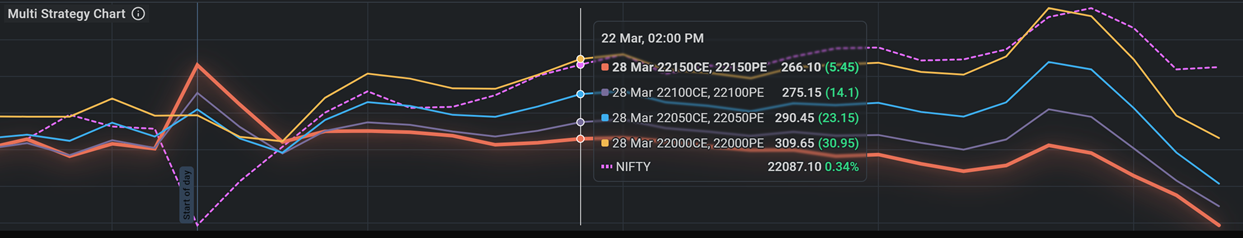

21 Mar expiry used

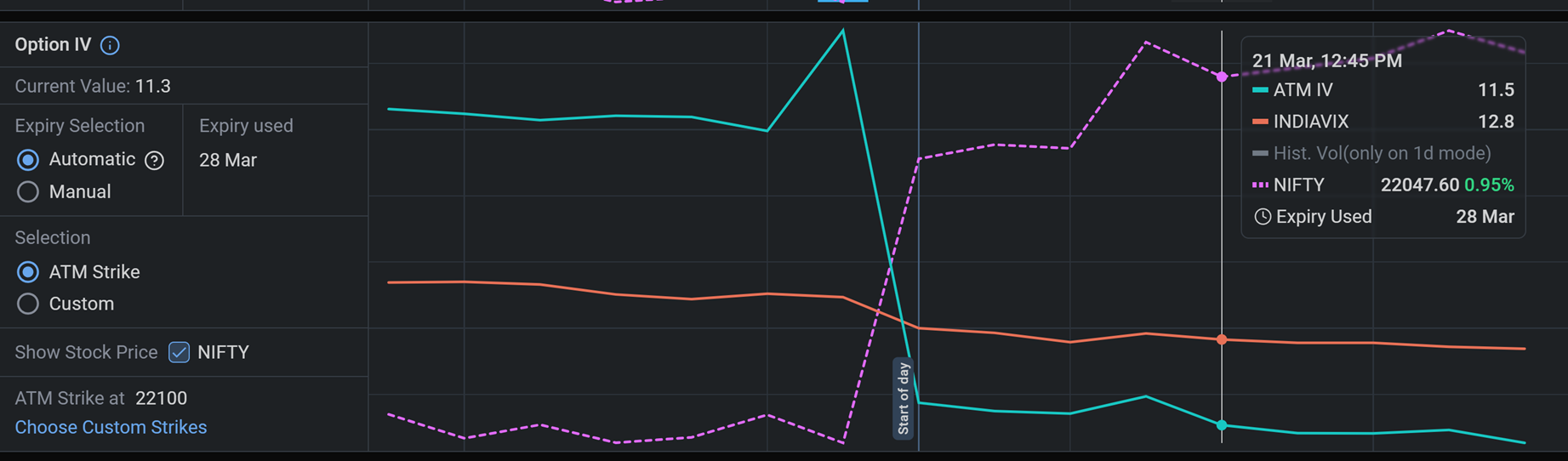

28 Mar expiry used

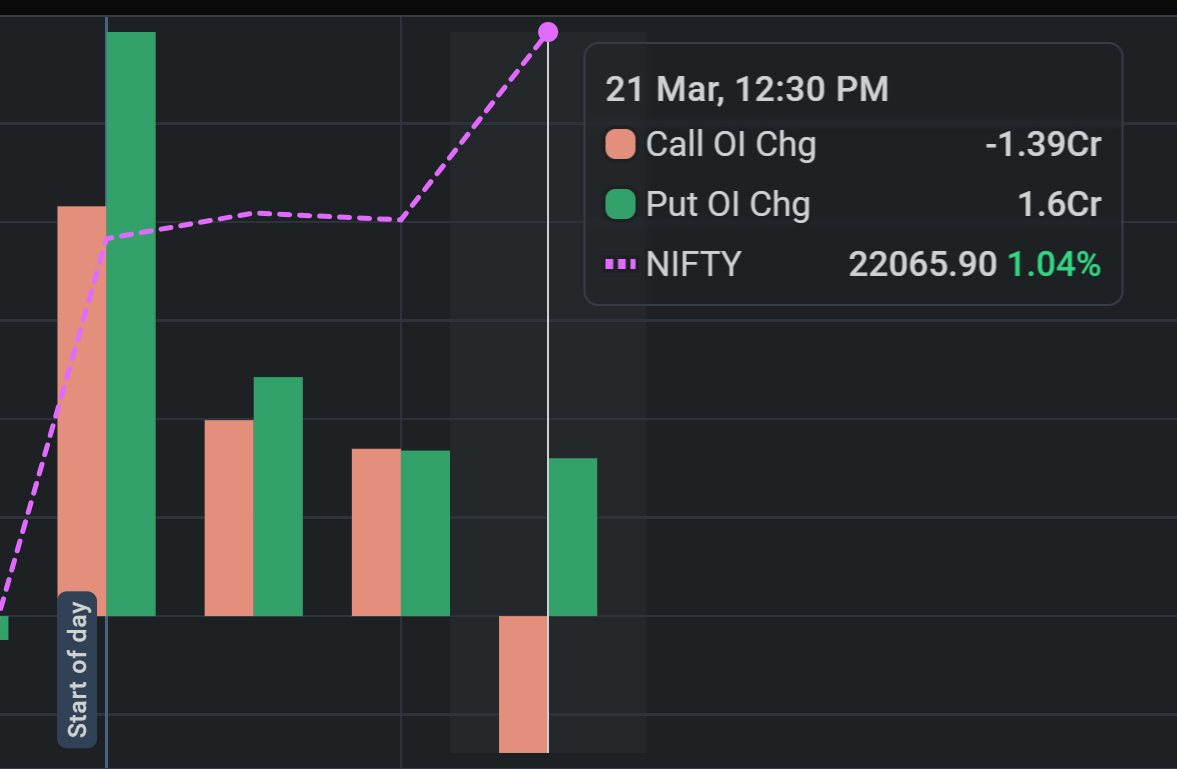

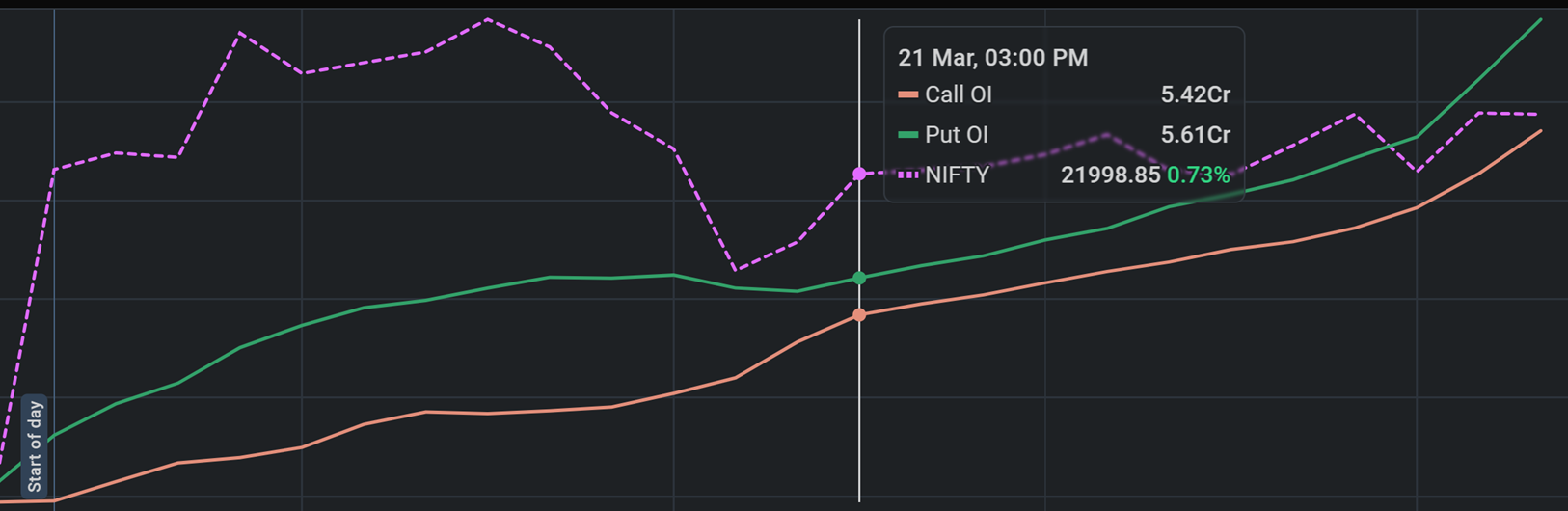

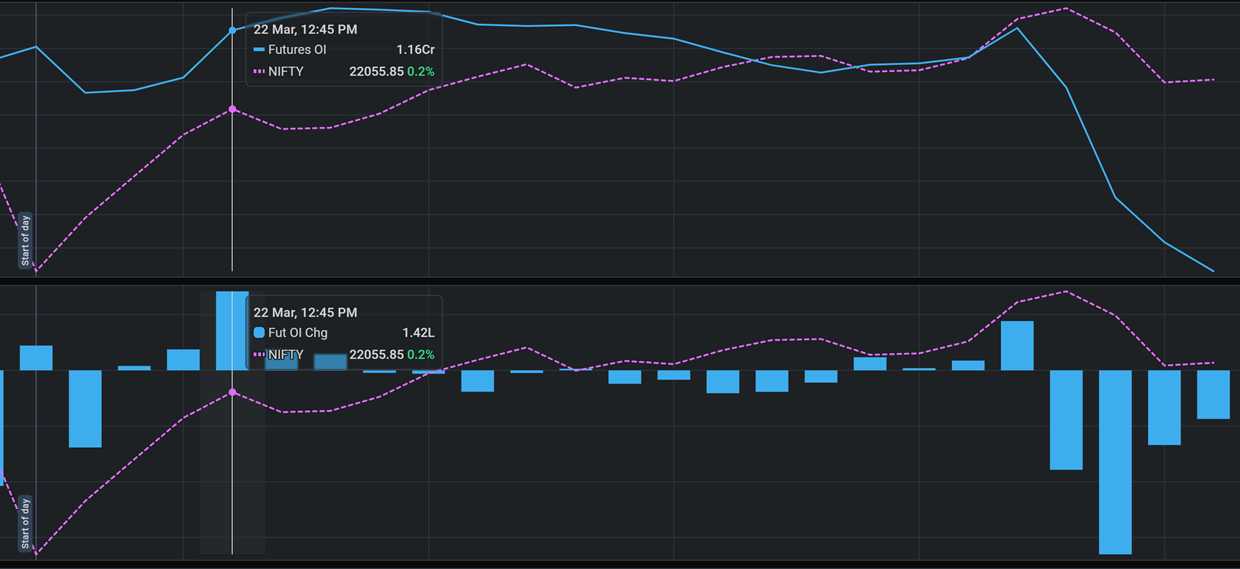

Check how Open Interest change affects NIFTY rate

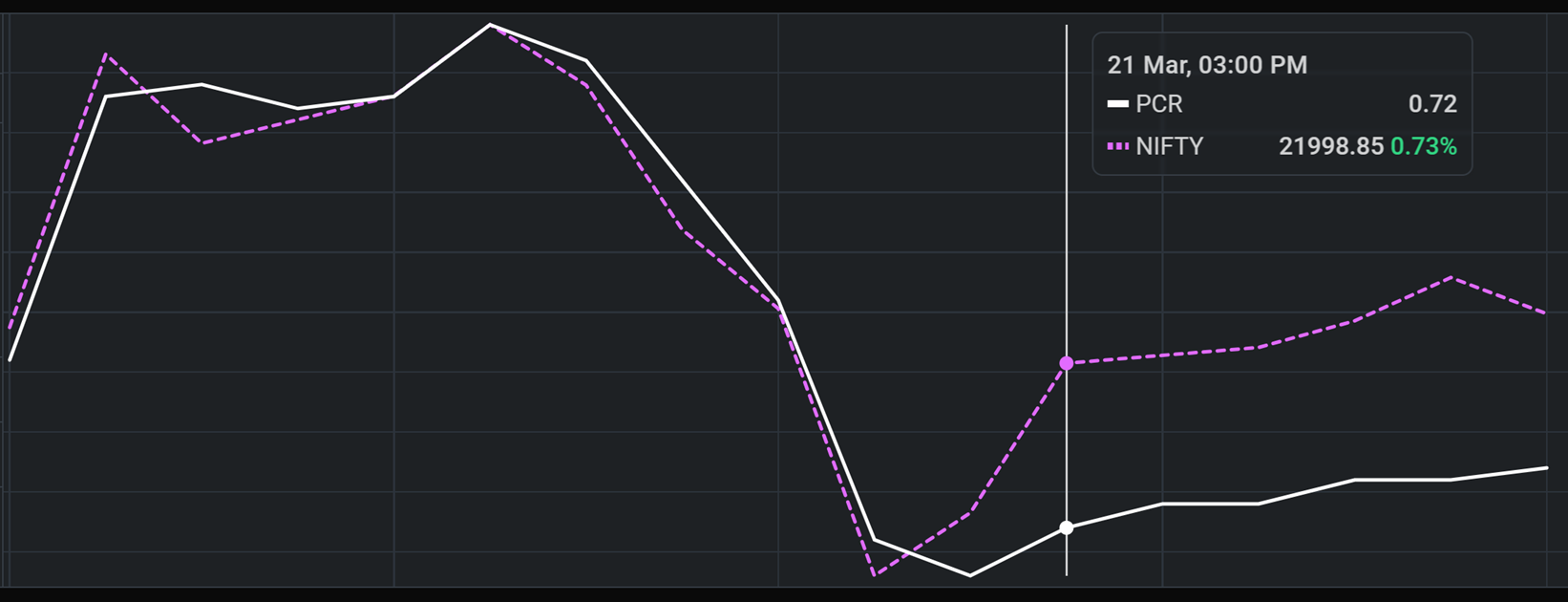

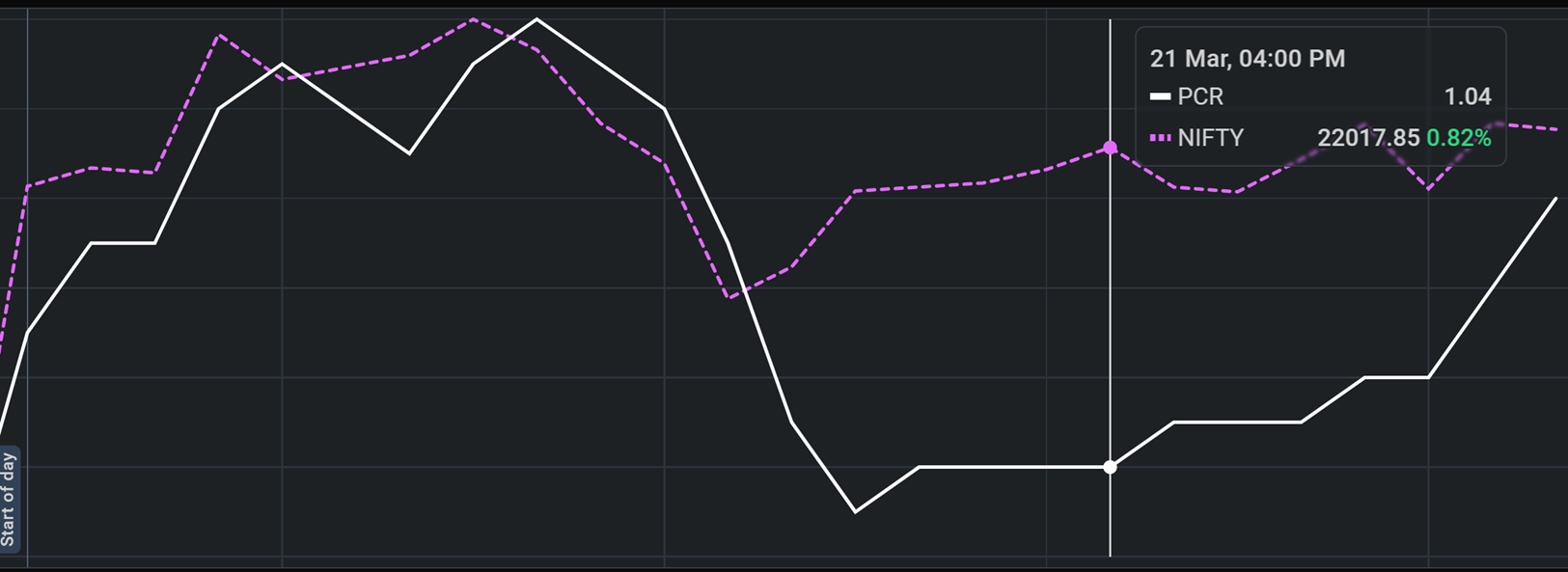

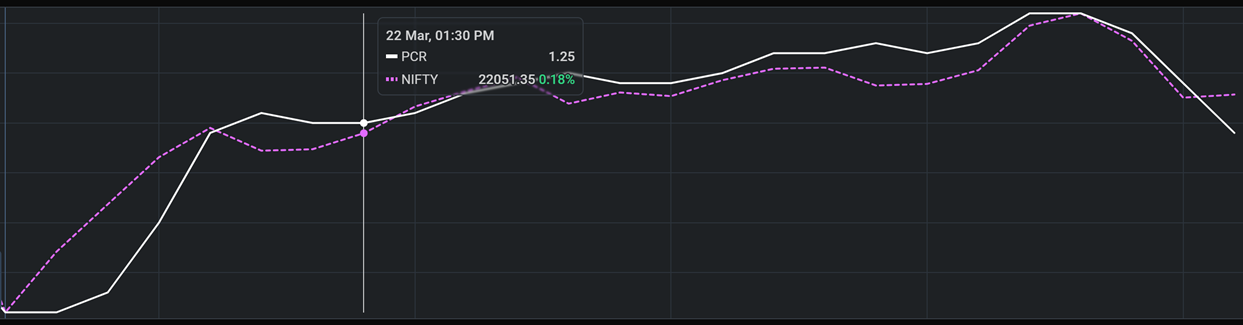

PCR effect

Open Interest Options cross using 21 Mar

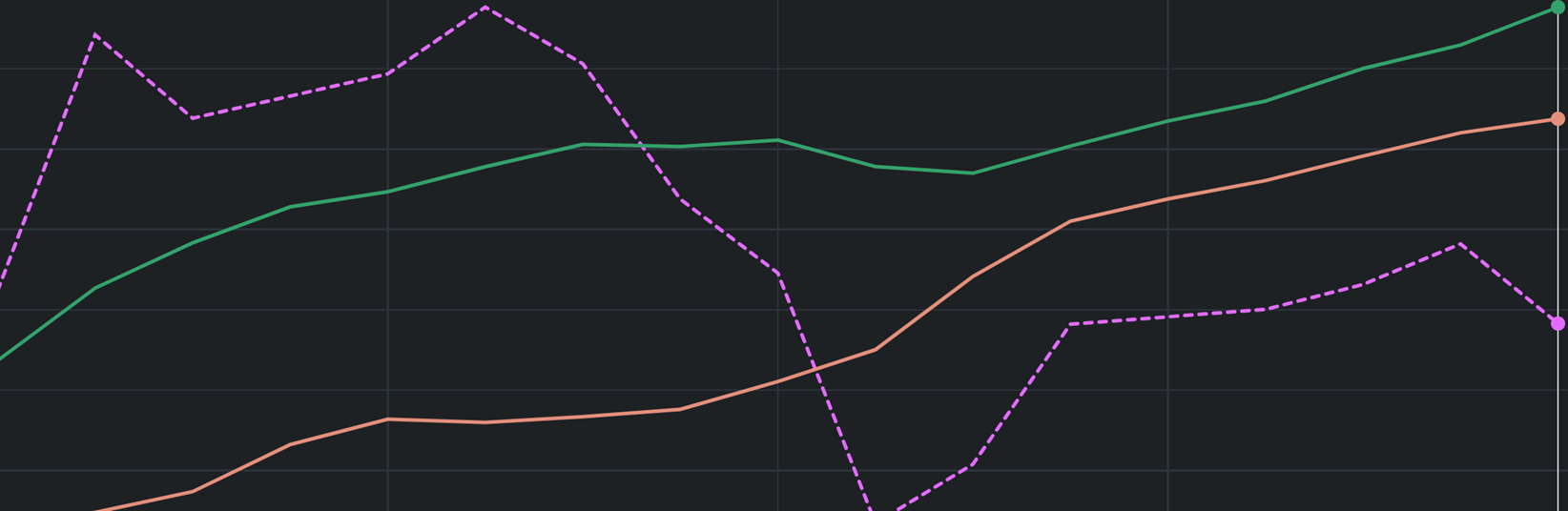

Open Interest Options using 28 Mar (next week)

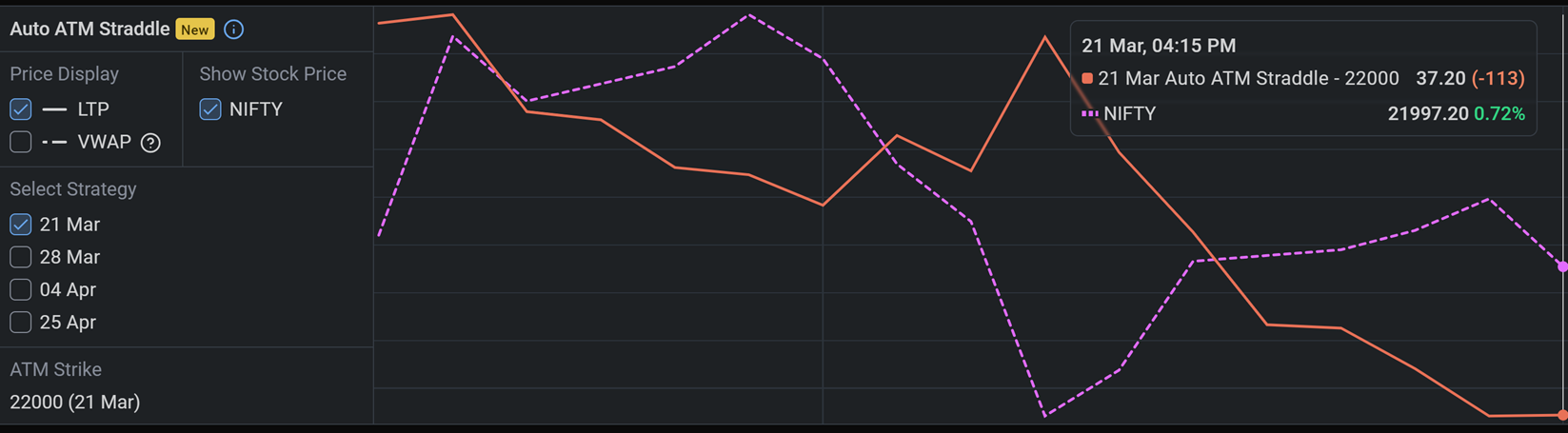

Auto ATM straddle 22000 21 Mar. it works in opposite direction to the nifty curve

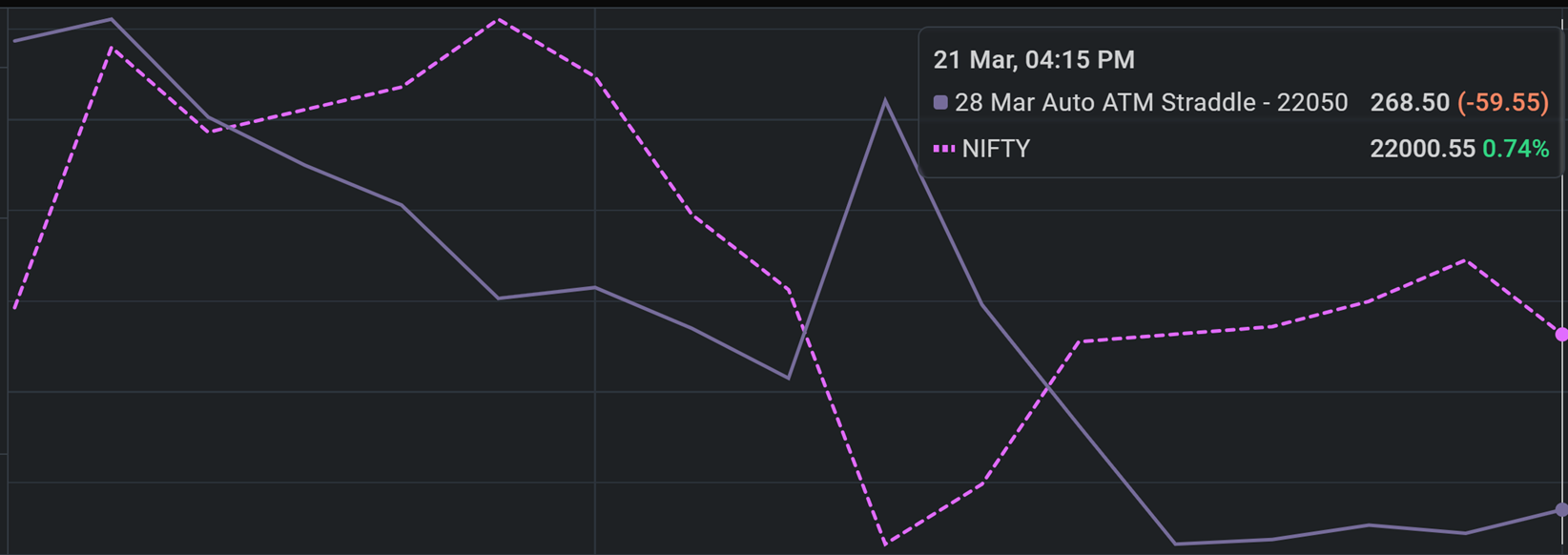

Auto ATM straddle 22050 28 Mar (next week) it also works in opposite direction to the nifty curve

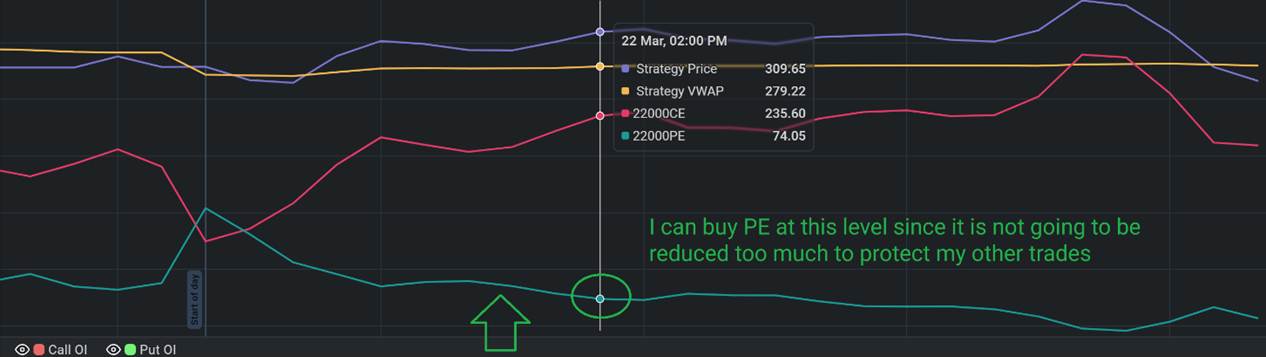

Open Interest Options using 28 Mar (next week)

After doish comment from fed

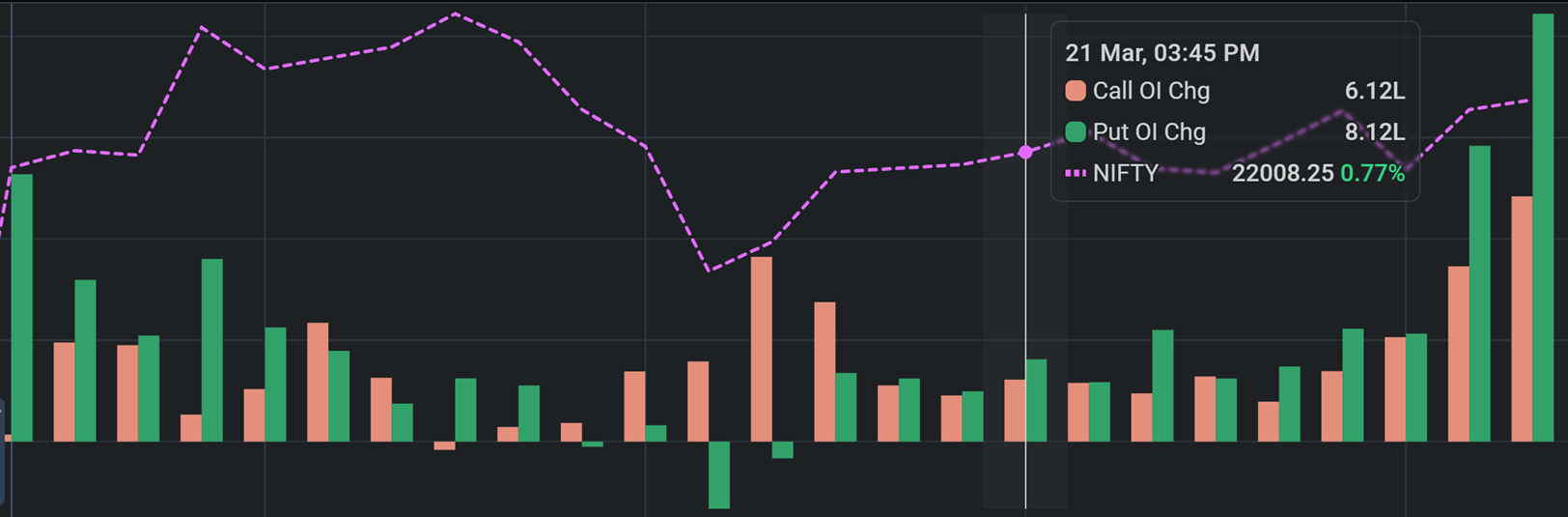

Open Interest Change Options using 28 Mar (next week)

Put call ratio

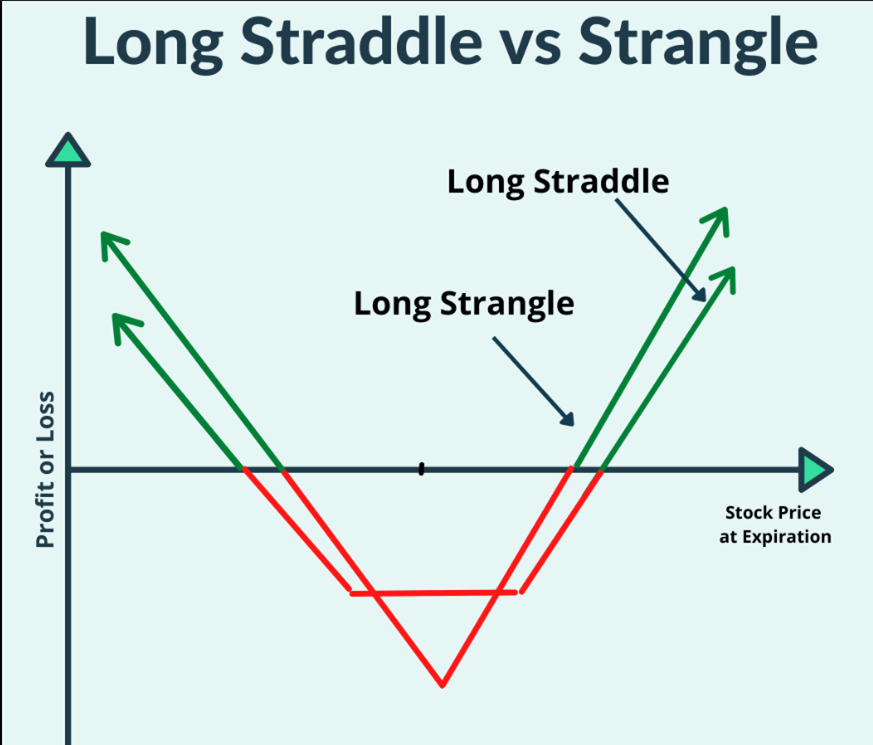

a straddle uses a call and put with the same strike price and expiration date,

while a strangle uses a call and put with the same expiration date but different strike prices

In a straddle trade, the trader can either long (buy) both options (call and put) or short (sell) both options.

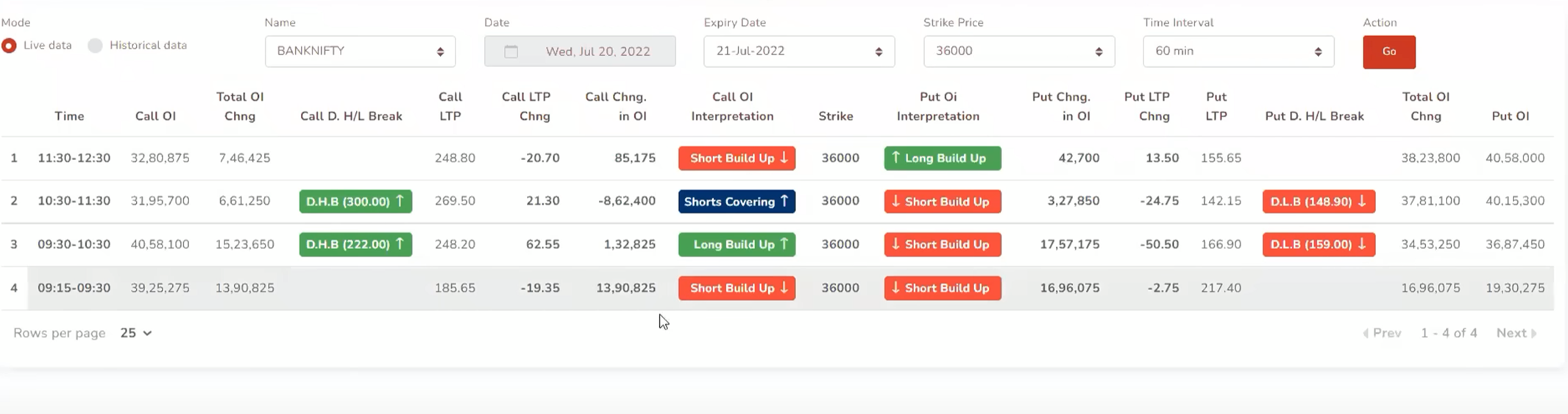

Open Interest change on Options

Put call Ratio

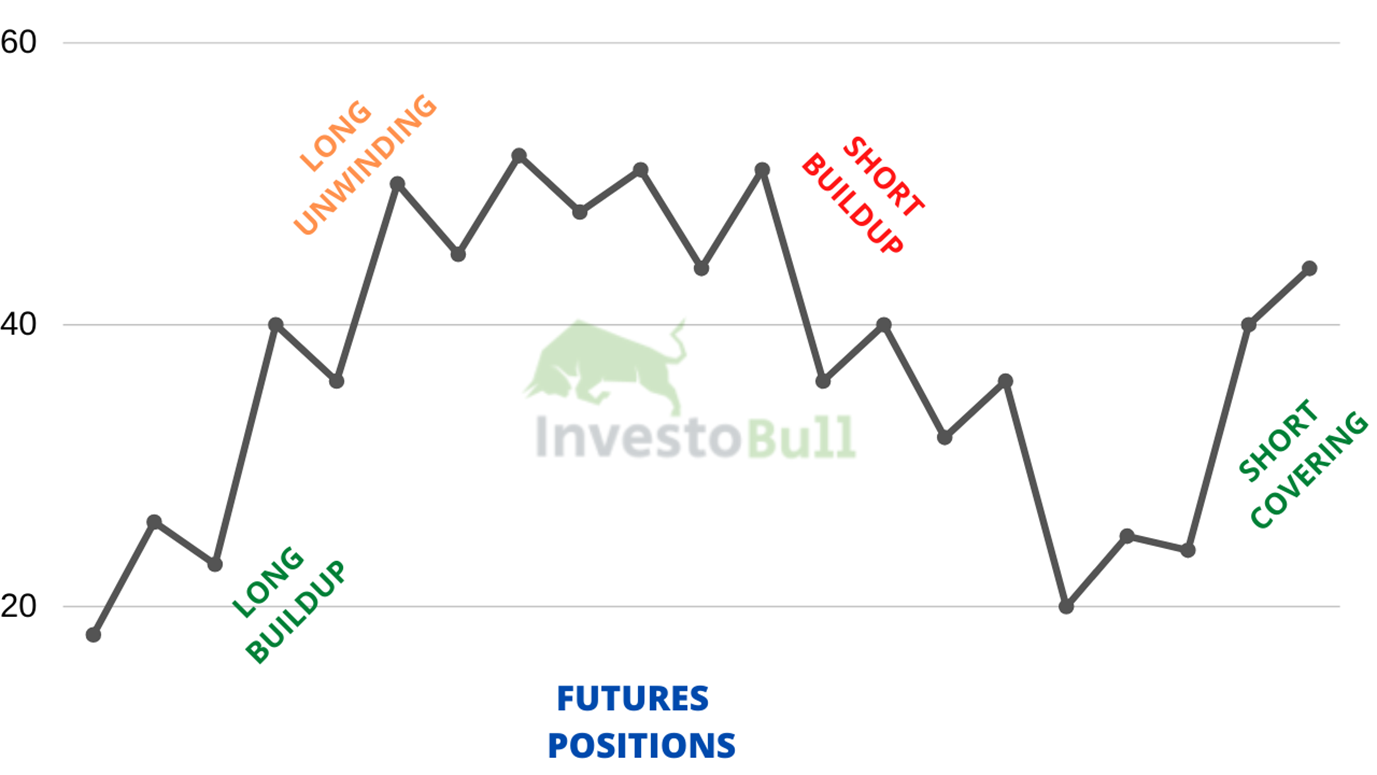

Open Interest change on Futures

Option IV

ATM straddle give more volatile

CE has more volatile but PE almost no impact

See the graph with volume

22000 ce sell @ 290 and after 1 hour buy @ 200

22000 pe sell @140 and after 1 hour buy @ 200

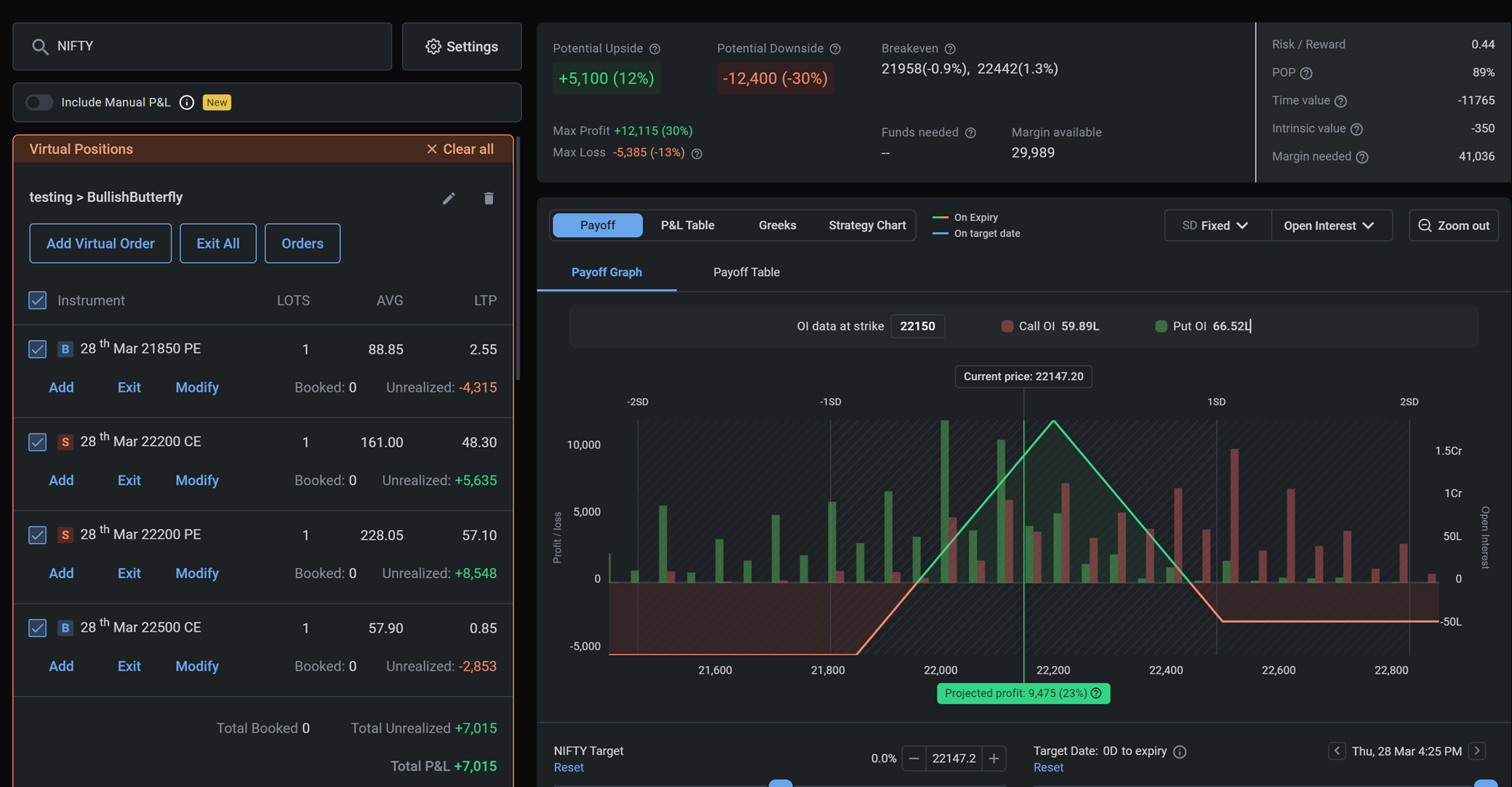

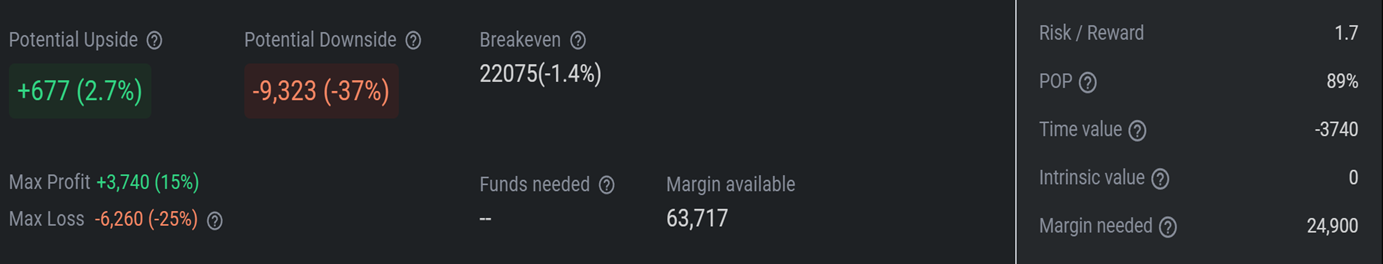

Margin needed 40k, to get profit of 5k within a month.Almost 12% profit easily.

I

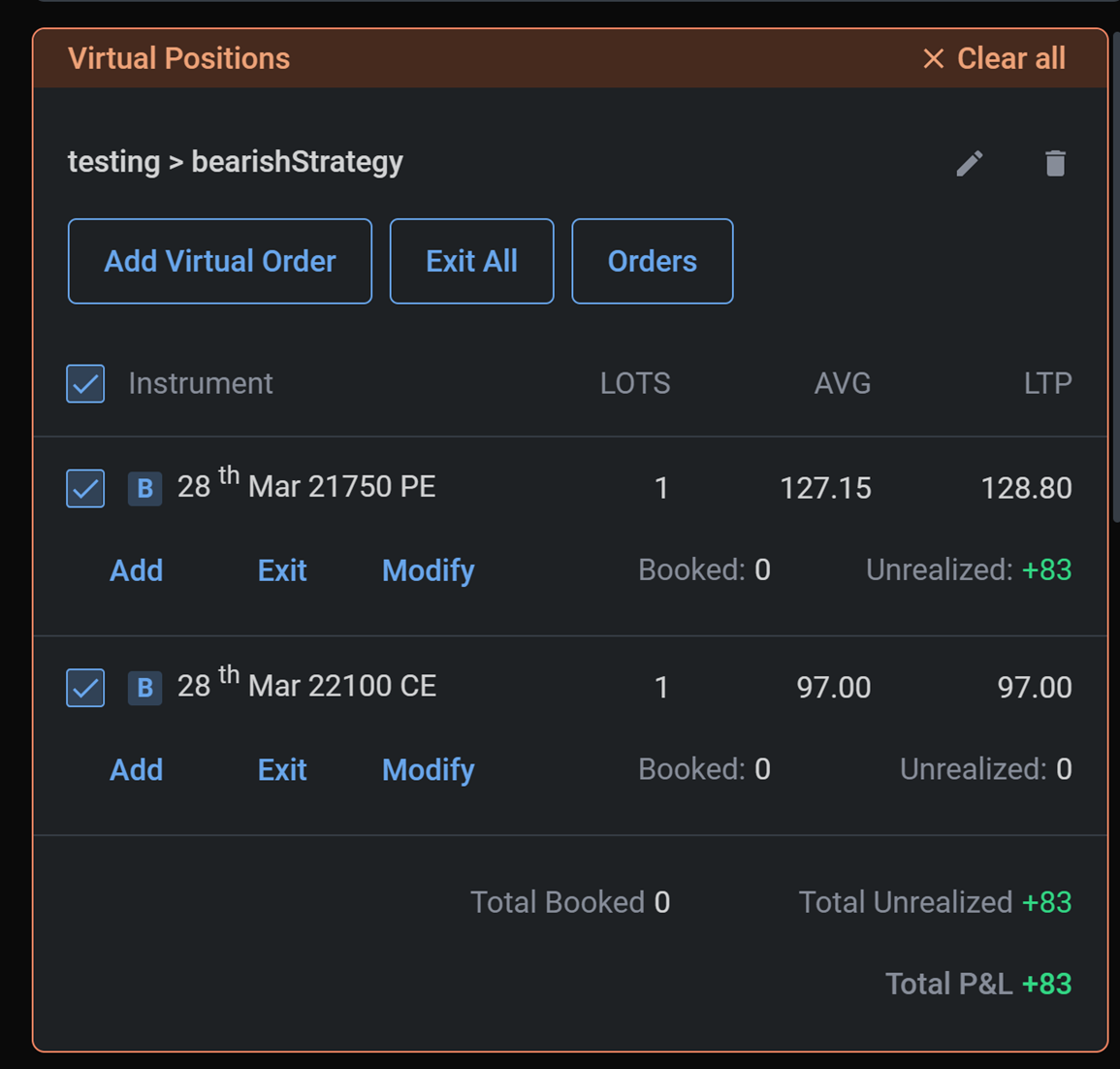

could have avoided that buying of 2 hedgings 28 mar 21850 PE and 28 mar 22500

CE to maximise the profit

However it reduces the high risk in case sudden crash or sudden price up

I can buy these when the time is closer by or when the hedging too much cheaper

Now they are worth just 2.55 and .85 rupees only

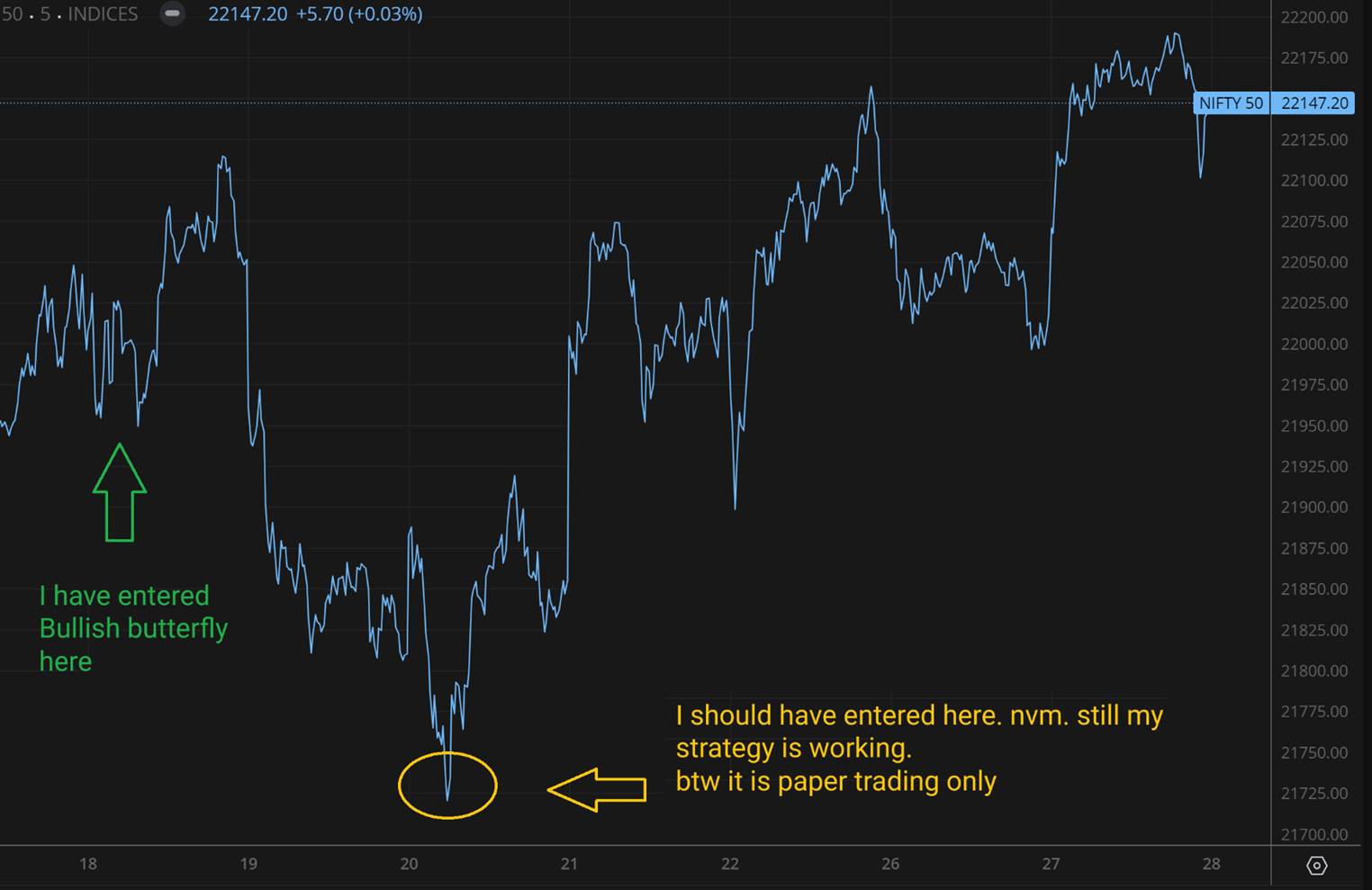

When nifty 22105

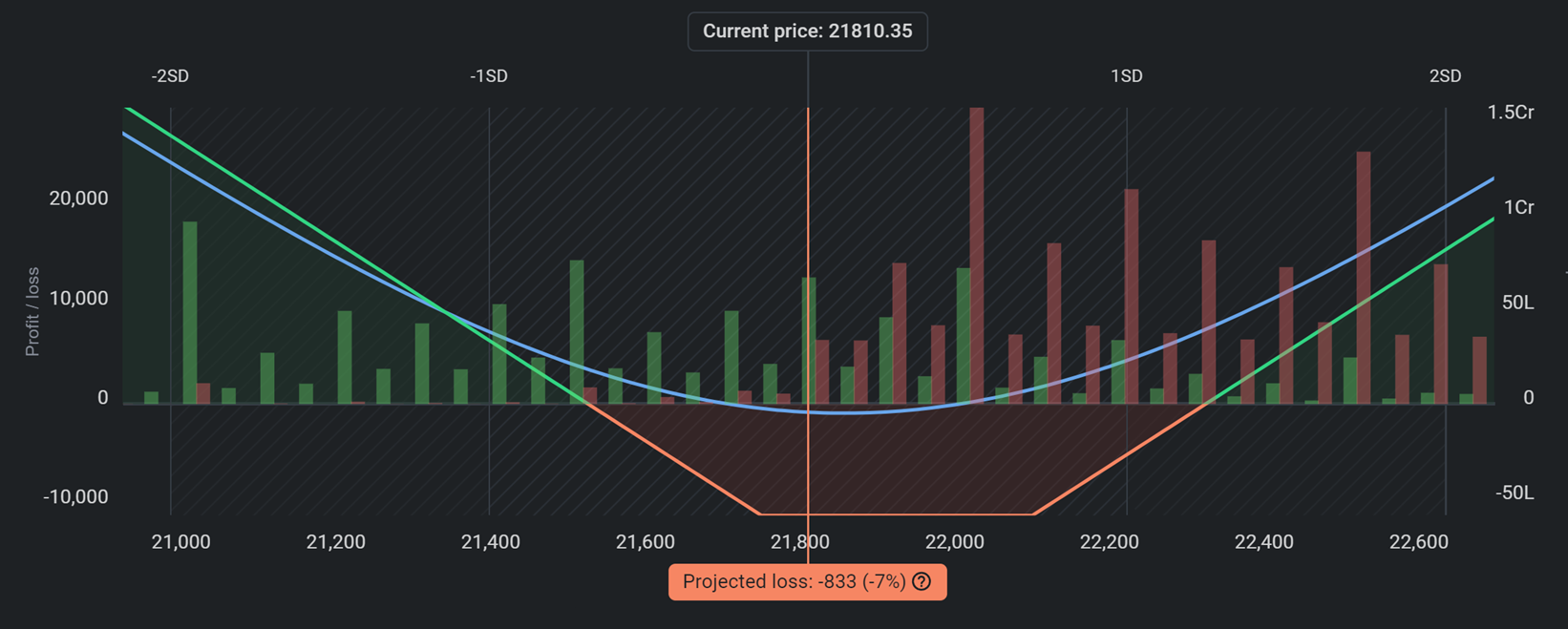

When nifty 21810

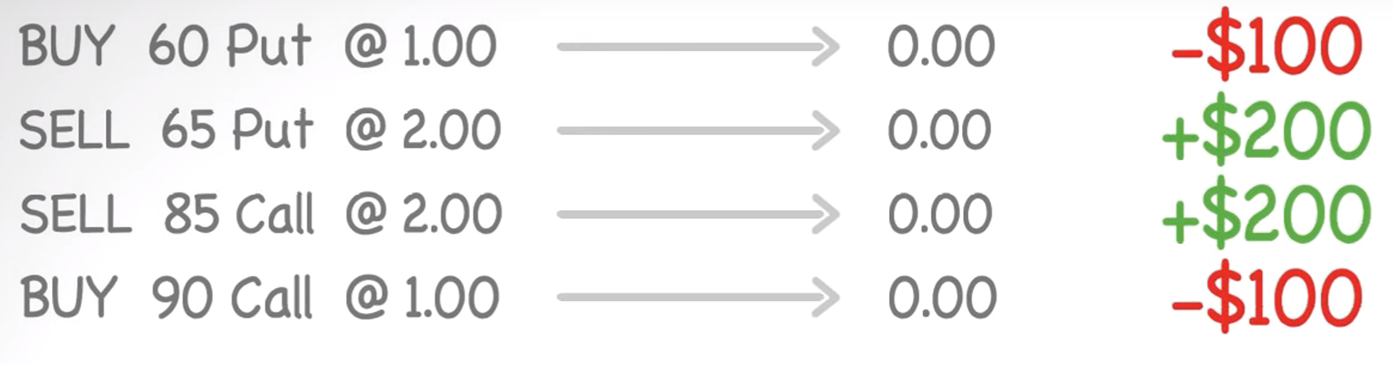

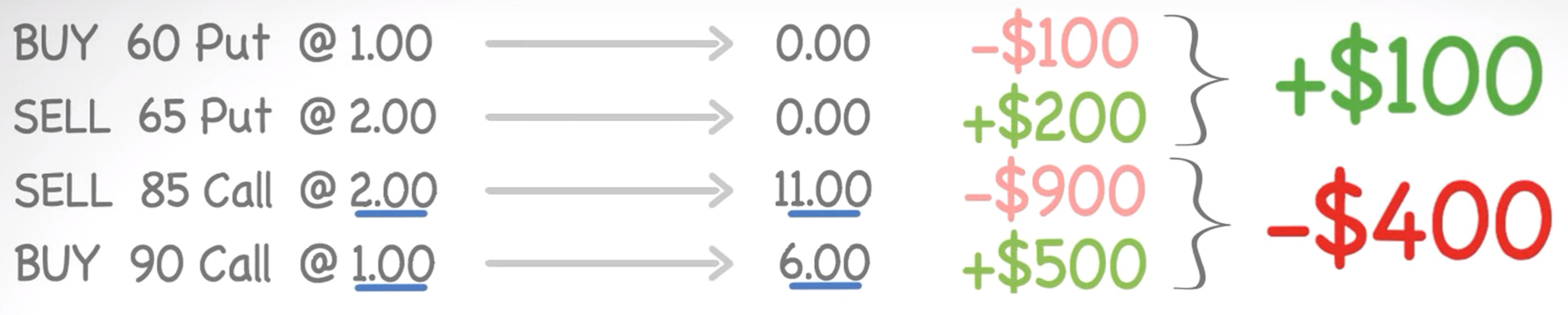

We can name this Bullish Butterfly Hacked

|

|

|

|

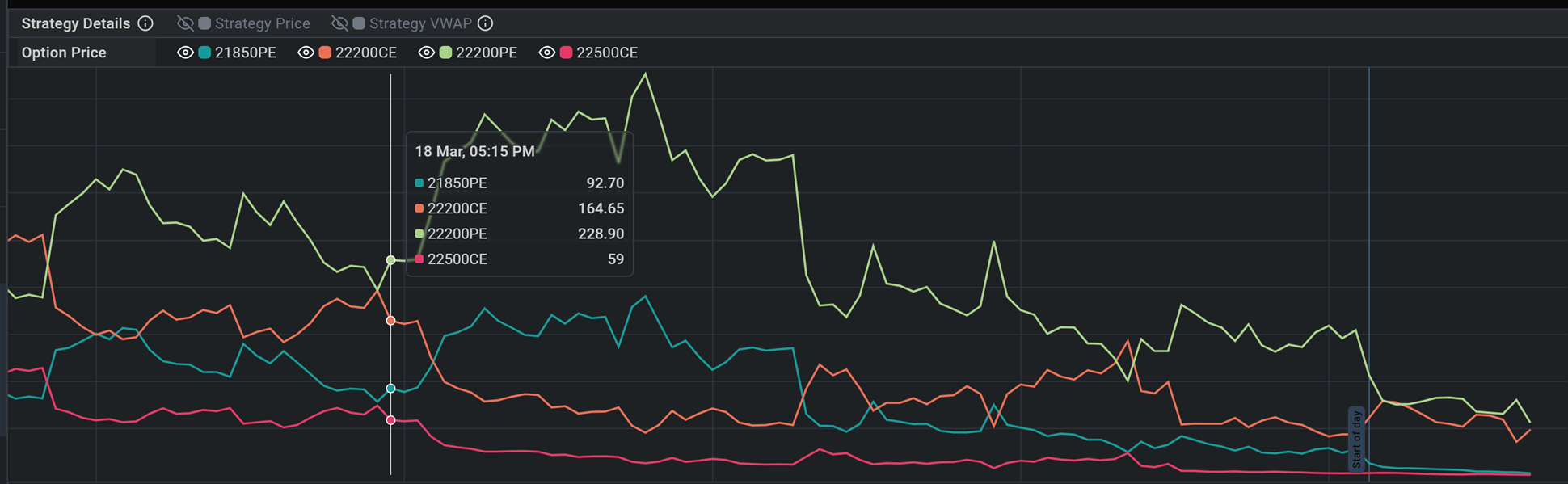

18-Mar |

|

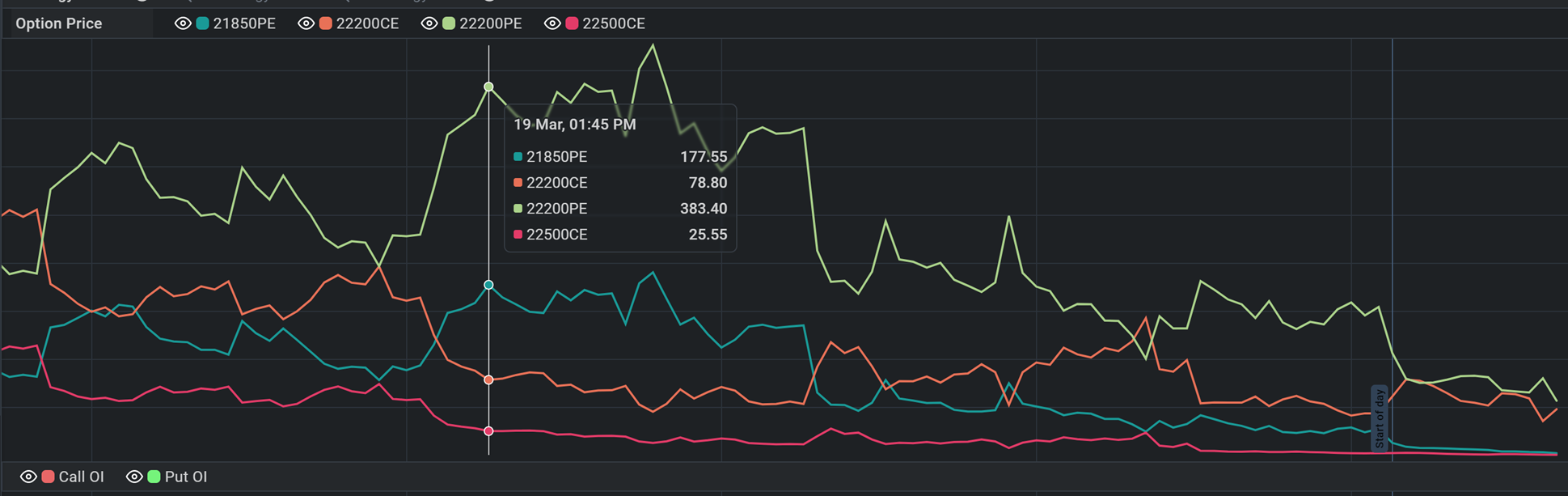

19-Mar |

|

|

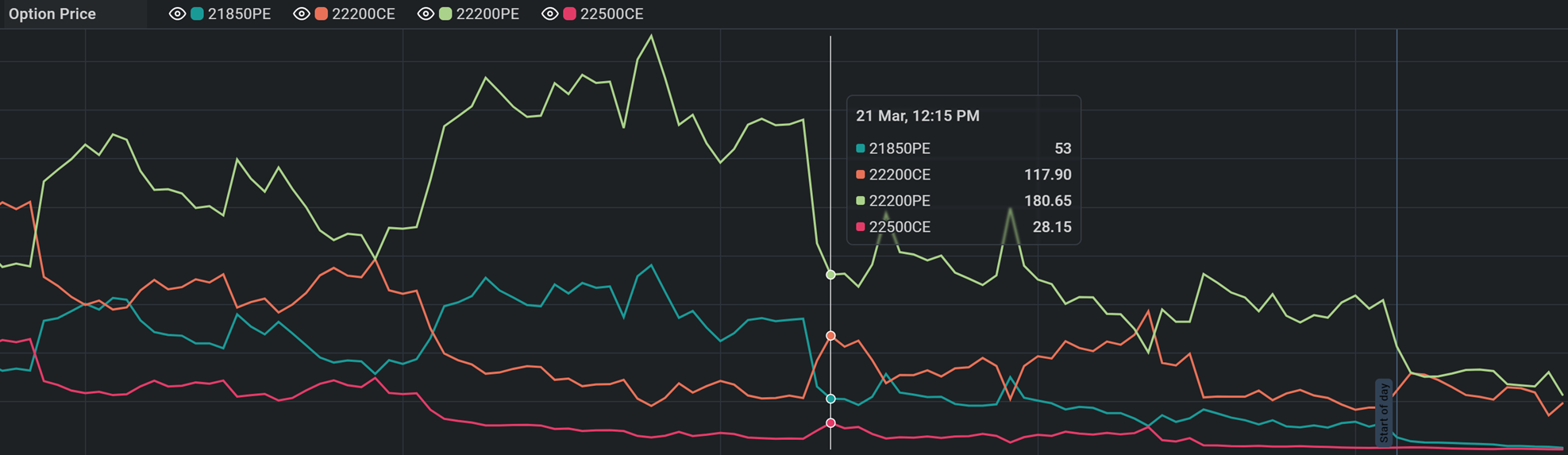

21-Mar |

|

|

|

|

21850 |

PE |

B |

-88 |

Sx2 |

177 |

89 |

B |

-53 |

124 |

|

Just look for cross |

|

22200 |

CE |

S |

161 |

Bx2 |

-78 |

83 |

S |

117 |

39 |

|

you can gain |

|

|

|

|

|

|

Profit |

172 |

|

Profit |

163 |

335 |

33500 profit |

|

22200 |

PE |

S |

228 |

B |

-383 |

-155 |

|

180 |

-203 |

|

|

|

22500 |

CE |

B |

-58 |

S |

25 |

-33 |

|

28 |

53 |

|

|

|

|

|

|

|

|

Risk |

-188 |

|

Risk |

-150 |

|

|

When nifty 22068

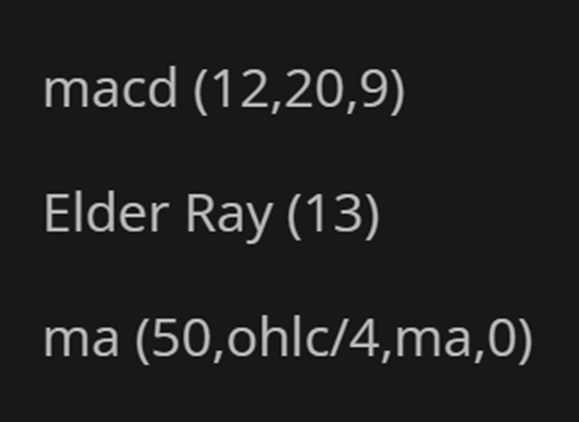

NIFTY2441022600CE Elder Ray Bull power and bear power

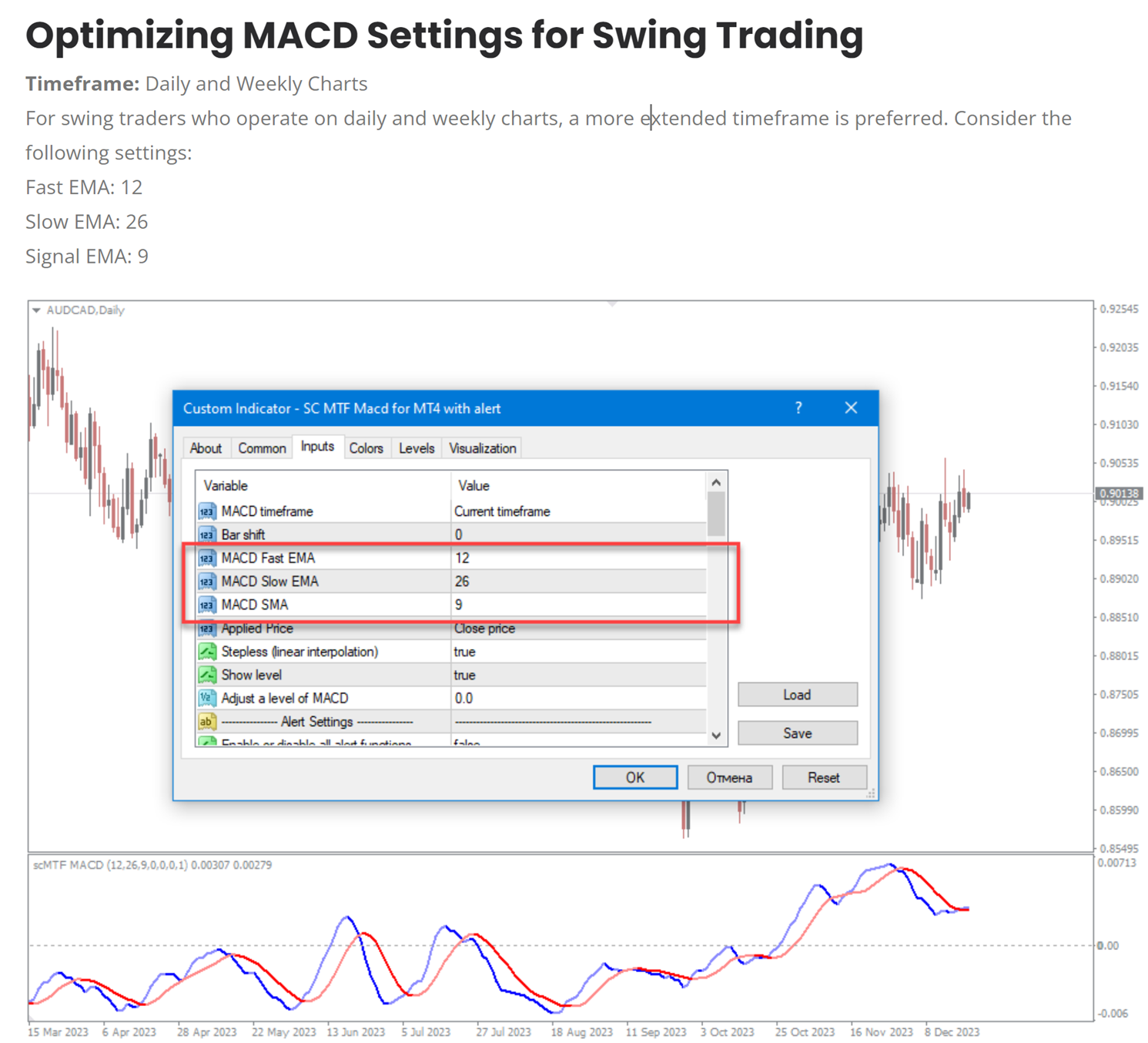

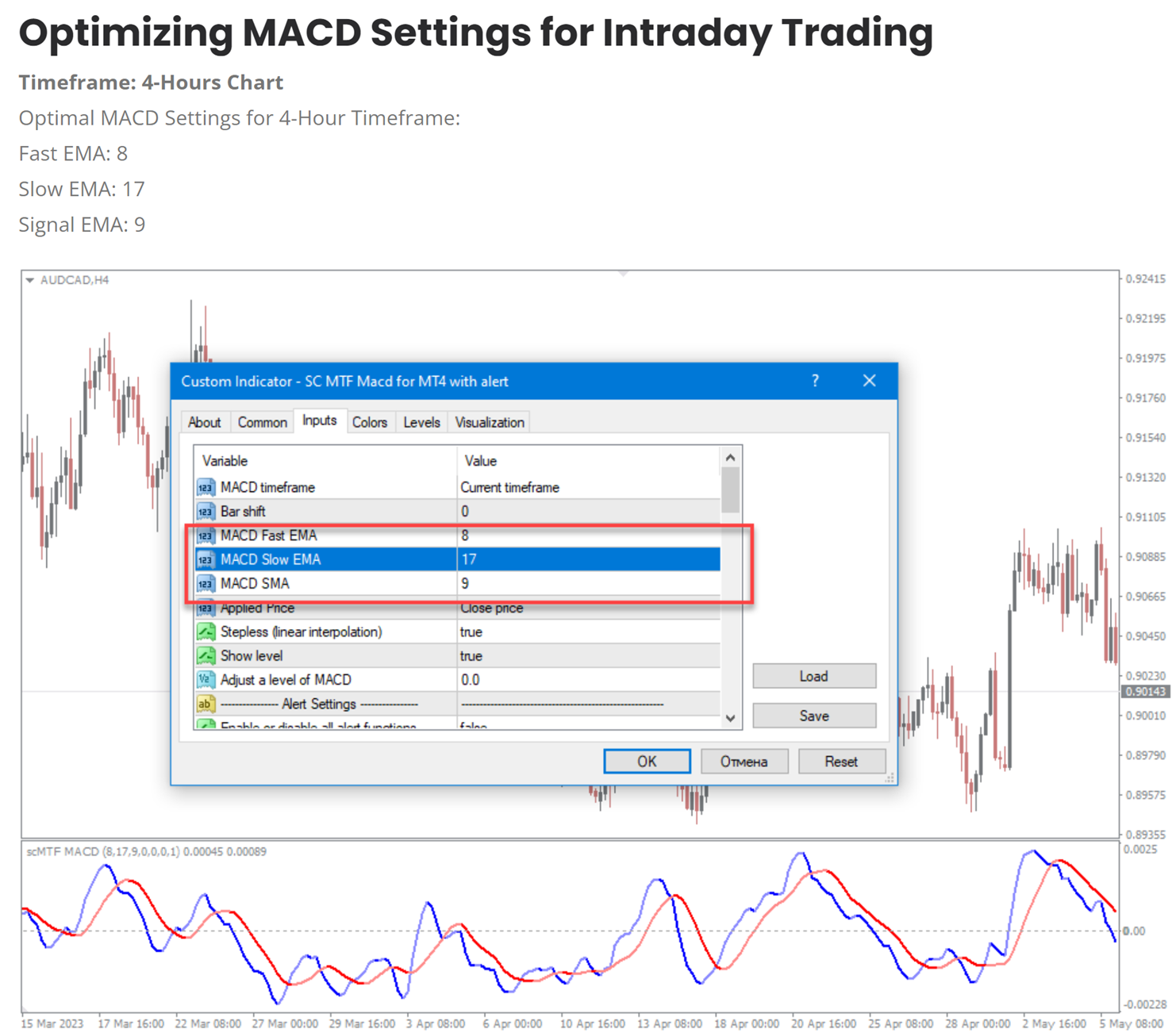

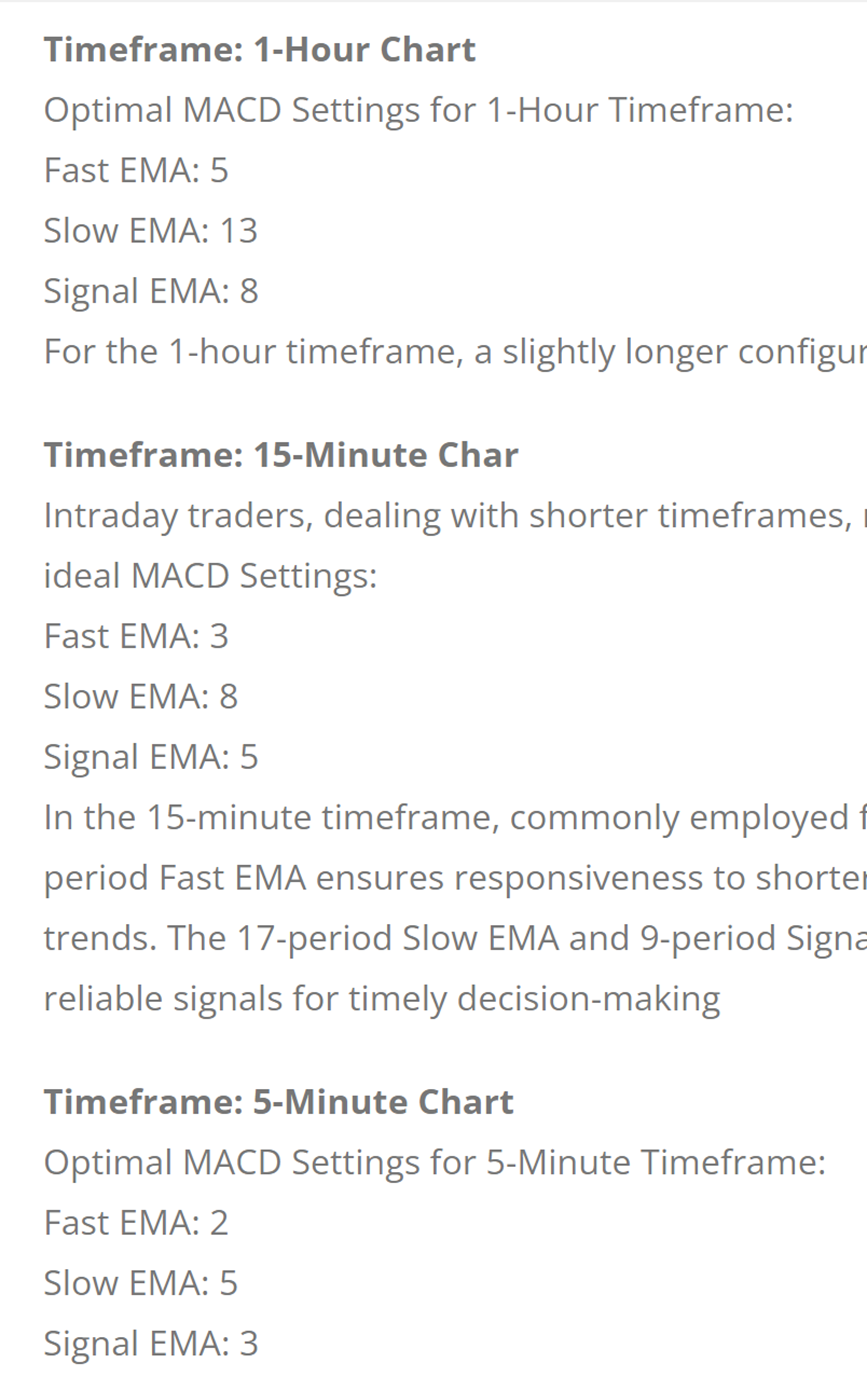

Top 10 MACD settings for effective trading

1. Standard (12, 26, 9): This is the default MACD setting and is widely used by traders. It’s a well-balanced setting that provides reliable signals in most markets.

2. Short-Term (5, 35, 5): This setting is suitable for aggressive traders who are willing to take on more risk for potentially greater rewards. It provides quicker signals but with increased potential for false positives.

3. Long-Term (19, 39, 9): If you’re a swing trader or prefer to hold onto your positions for longer, this setting may suit your trading style. It provides fewer signals, but they are usually more reliable.

4. Scalping (3, 10, 16): Ideal for scalpers and day traders, this setting provides fast signals. Remember, while it can lead to quick profits, the risk of false signals is also high.

5. Cryptocurrency (20, 50, 9): With cryptocurrencies gaining traction, this setting can be a great ally. Given the high volatility of the crypto market, these settings help balance out the noise.

6. Forex (8, 17, 9): For Forex traders, this setting has been found to be effective, considering the market’s 24-hour trading window and the associated volatility.

7. Conservative (24, 52, 18): For traders who prefer a slow and steady approach, these settings provide fewer but more reliable signals.

8. Trend-Following (7, 28, 7): Ideal for traders who love to ride trends, these settings help in identifying and staying with the trend.

9. Swing Trading (5, 15, 5): A perfect setting for swing traders, offering a good balance between signal frequency and reliability.

10.

Contrarian (15, 35,

5): For those who like to go against the trend, this setting can help

identify potential market reversals

BUY ON BUY SIGNAL ONLY IF MARKET IS IN UPTREND

ADD 200 day moving average

MA Envelope

Open interest

PMO 35 20 10 Overbought and Oversold

Pring KST

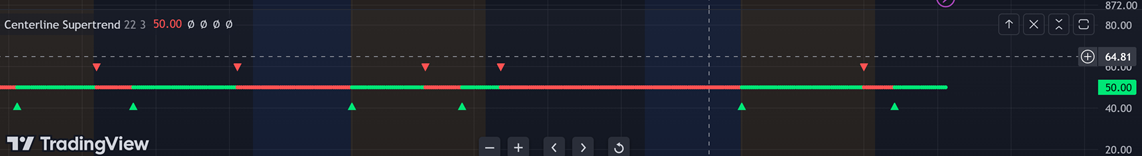

SuperTrend

VWAP

VOLUME CHART

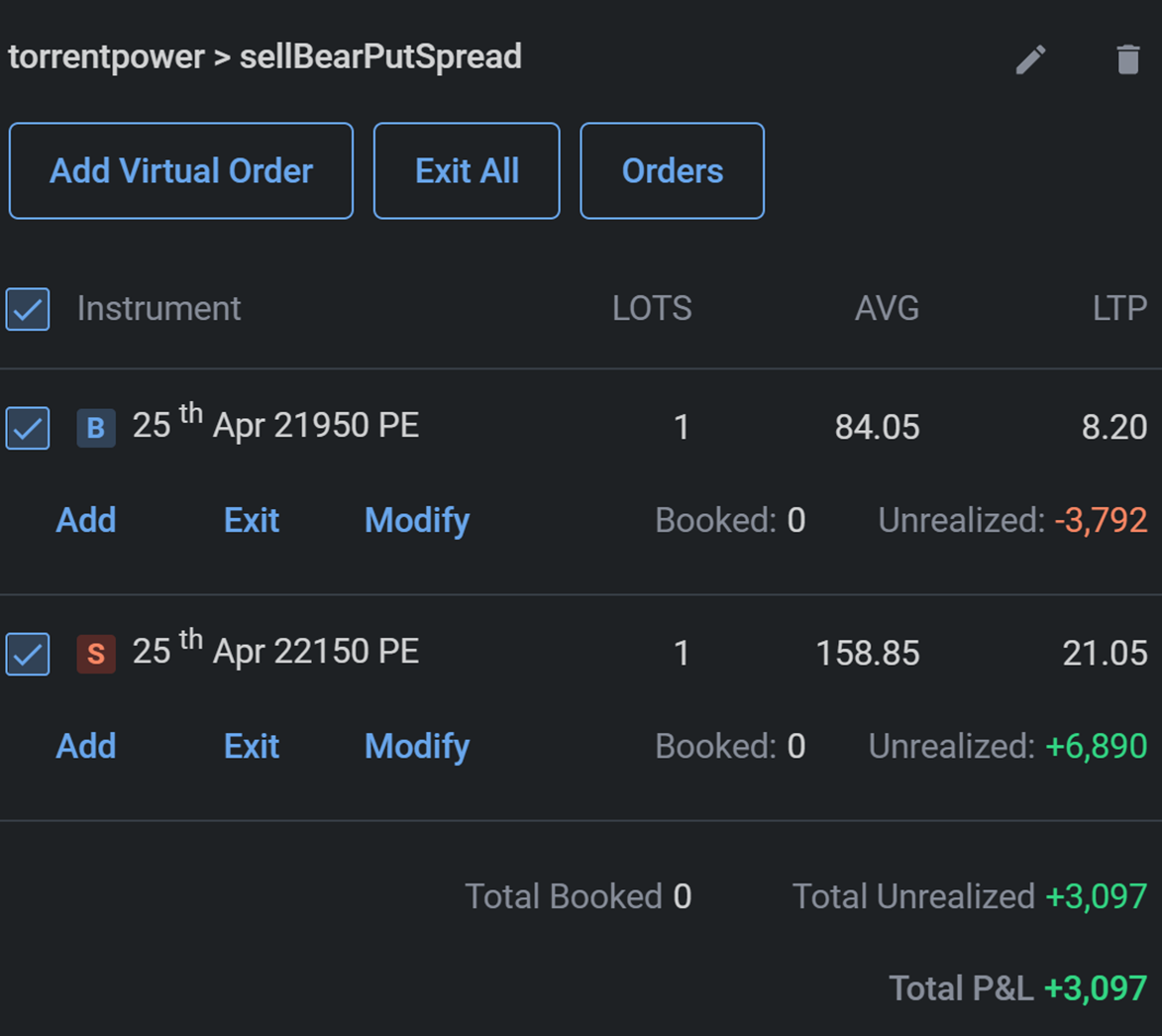

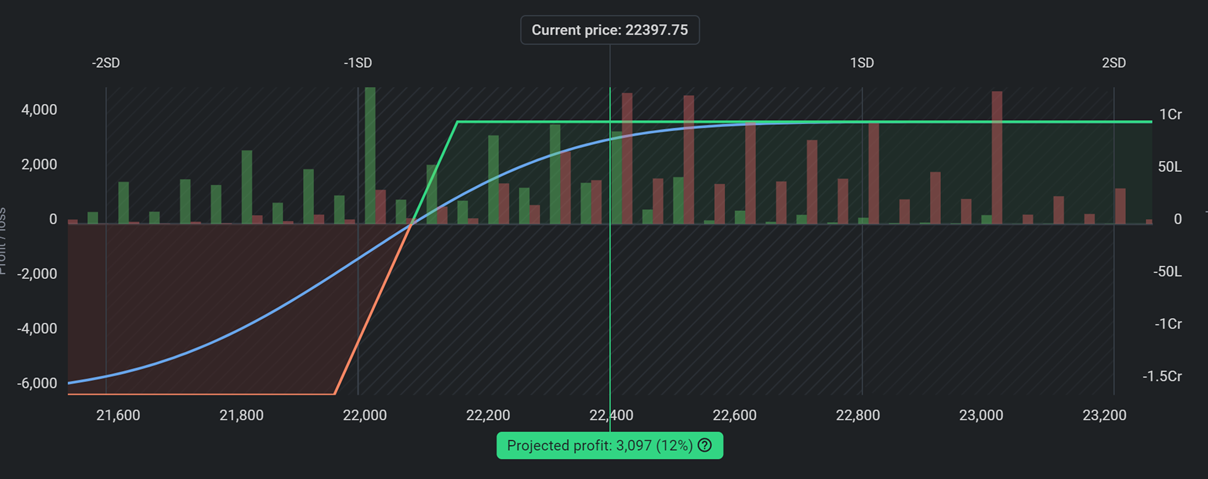

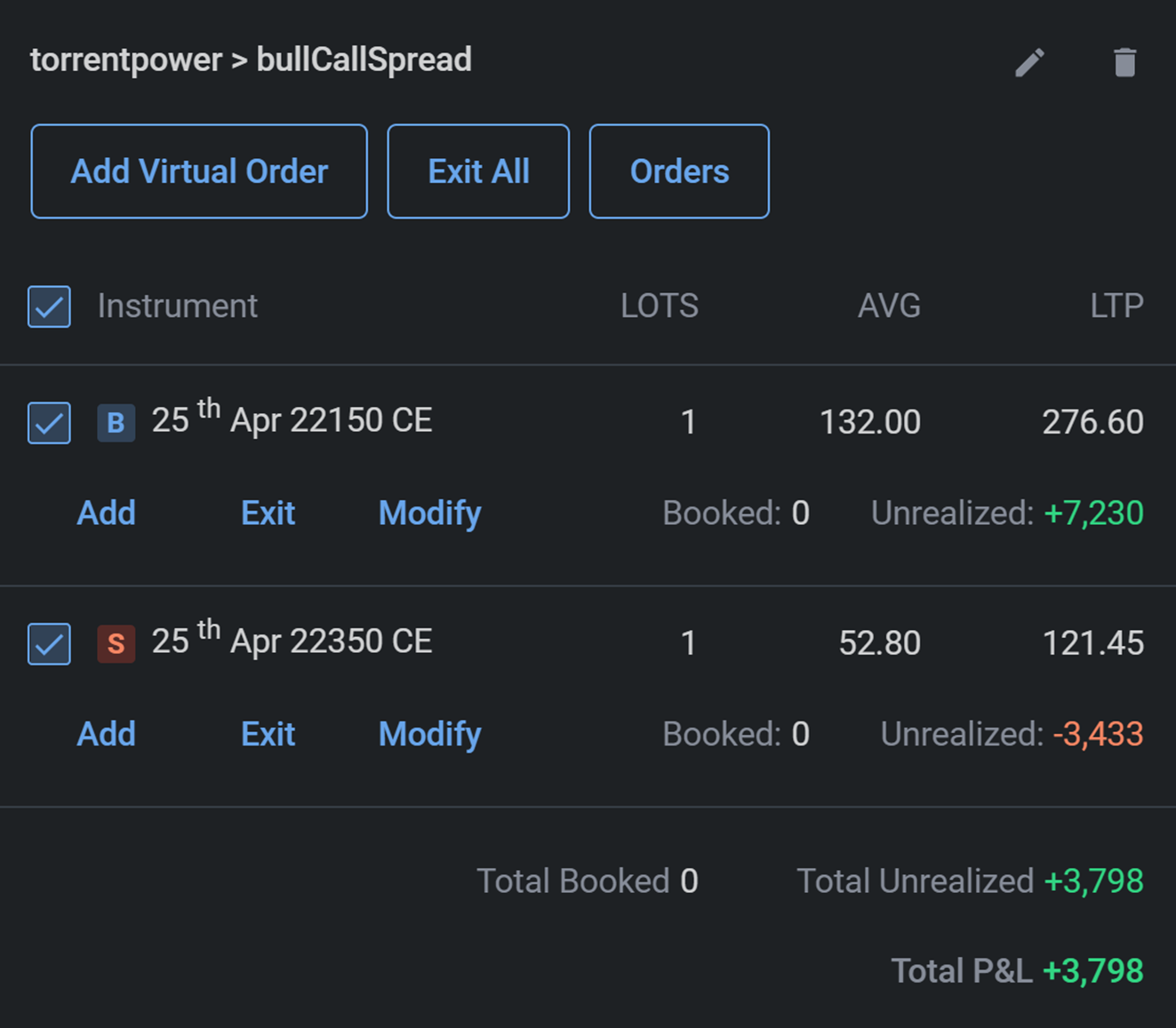

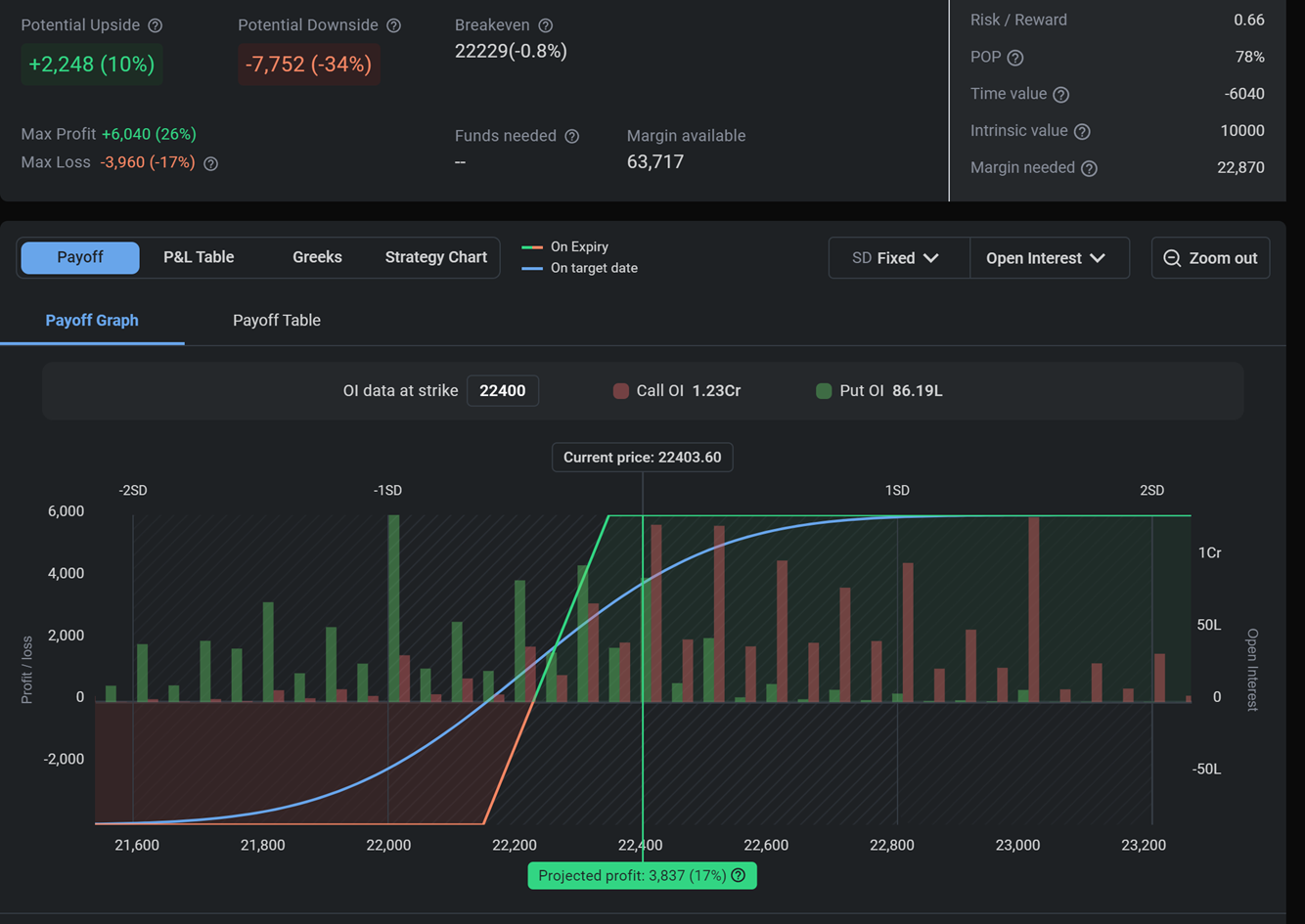

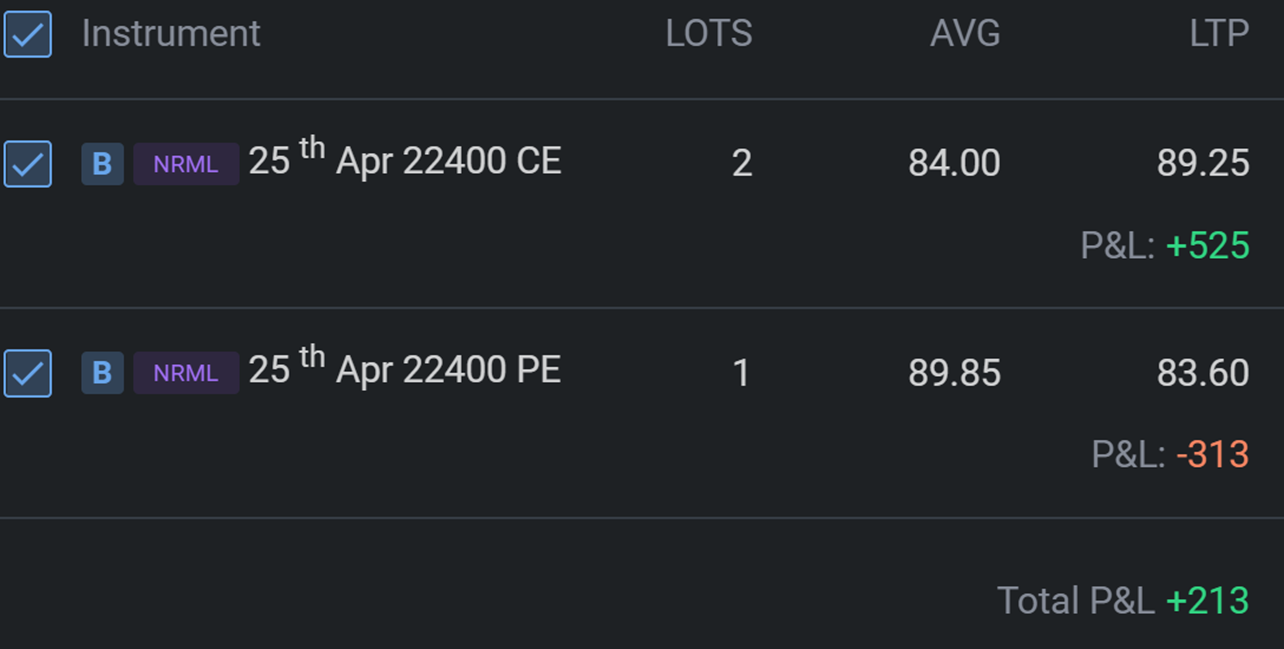

The following virtual trades are done on Monday 22 April 2024 and achieved profit in Tuesday 23 April 2024

Trying Strap

KLINKER indicator

CCI indicator

KELTNER CHANNEL (1) 50,3 (2) 50,4

Keltner Channel for SECRET scalping Strategy - English Subtitles - Tamil Audio (youtube.com)

https://www.youtube.com/shorts/4RKq7nnxZpY?feature=share